This is an earnings report for paid subscribers. But I wanted to provide this one to everyone so you may know what it looks like.

If you want to receive these kinds of reports in the future, please consider our current paid offering at a 26% discount.

Adyen provided stellar results this last half year. (H2 2024)

I still can't believe we were given the opportunity to buy this company at 700 in 2023 (now trades at almost 1800).

You can find my deep dive on Adyen through the button below. (temporarily available for free)

Key results

Growth

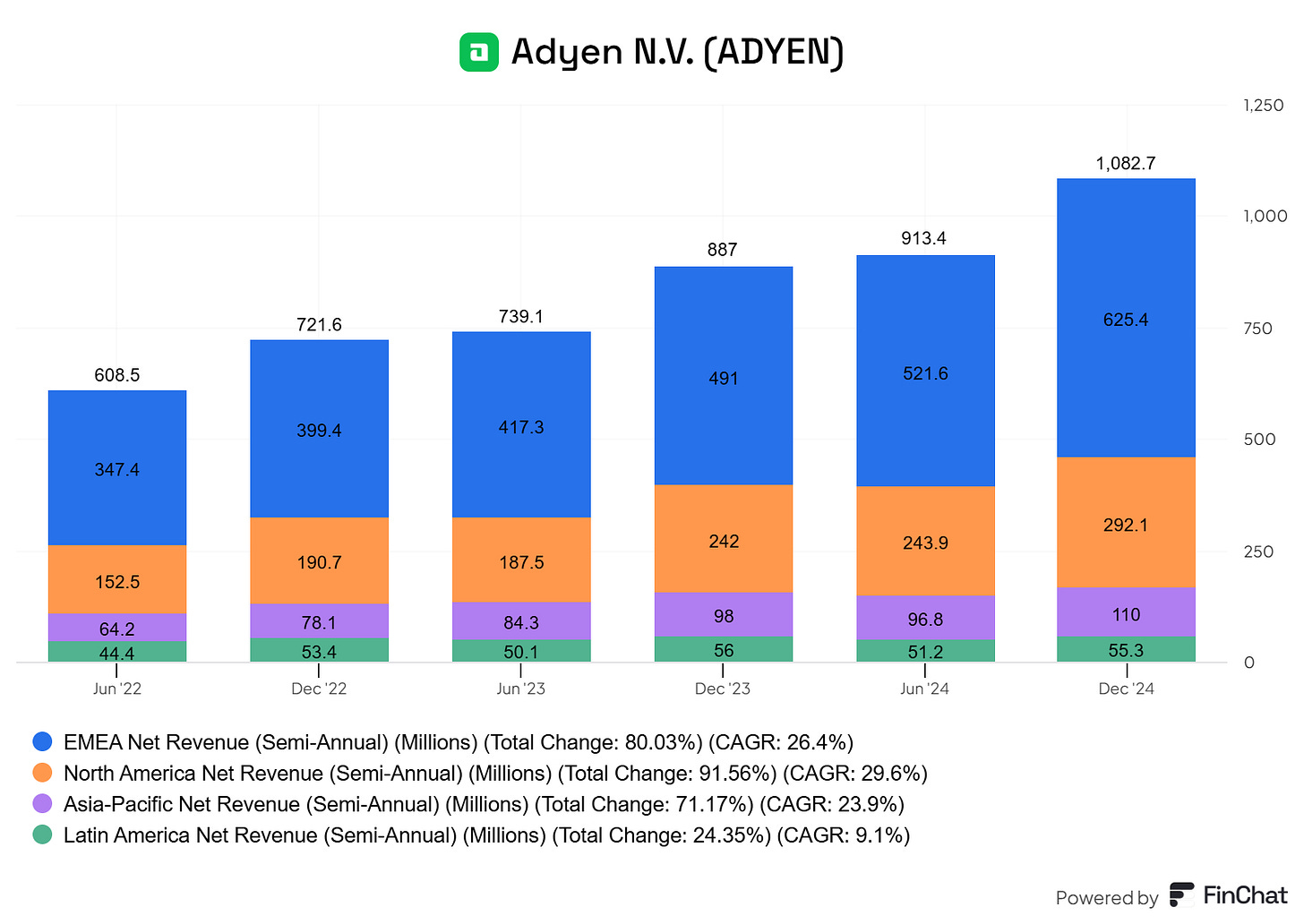

Net revenues grew by 22% in the second half of 2024, reaching close to €1.1 billion.

The company expects a slight acceleration in net revenue growth in 2025 compared to 2024.

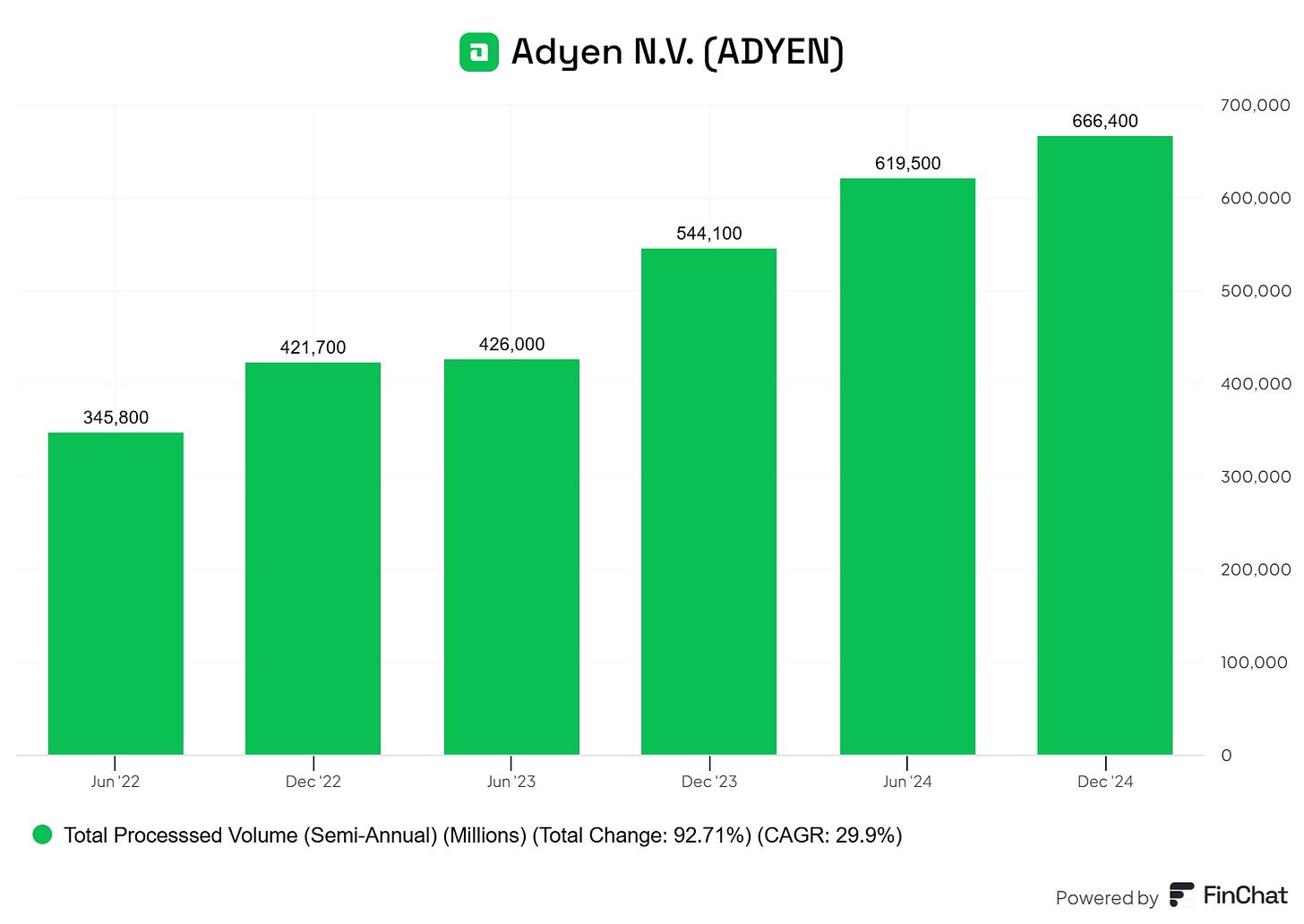

Processed over $1 trillion in volume over the past year.

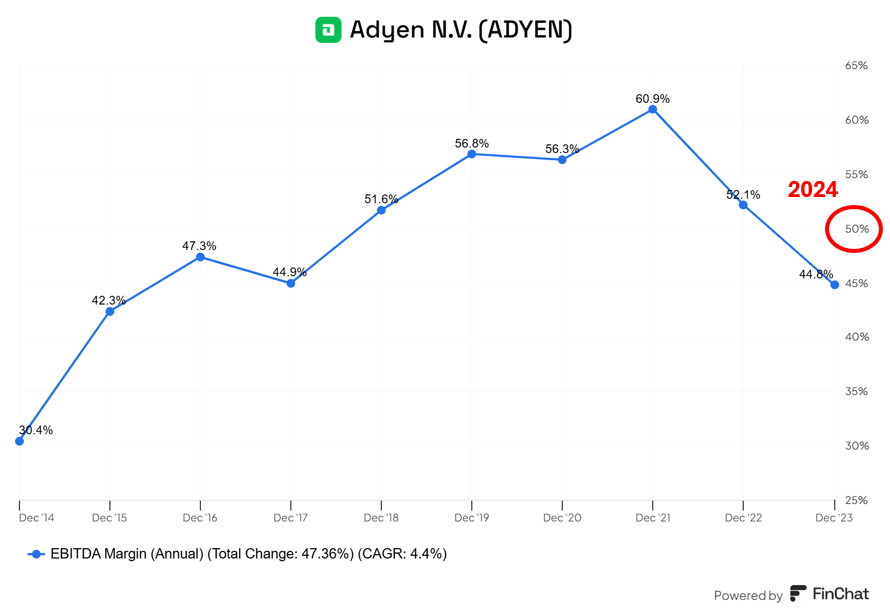

Margins

EBITDA Margin: Expanded to 53% in the second half of 2024 and just under 50% for the full year.

Future EBITDA Margin: Expected to continue expanding in 2025, but not at the same rate as in 2024.

Growth by Region

EMEA was the fastest-growing region in the second half of 2024. (strategic investments in Japan and India) Their positioning in India is a typical long-term Adyen play, where in the short-term, impact will not be meaningful, but over the long-term, India is poised to become one of the leading economies in the world, and Adyen wants to be there for the ride

North America continues to gain market share.(Adyen is winning from Braintree (Paypal)

Latin America Saw acceleration in growth on a constant currency basis.

Here is the net revenue breakdown by region over the past half years.

And a total process volume (the bread and butter) that keeps on growing.

Finchat is the only service I know of that provides these segmented KPIs. What’s even more astounding is the speed in which they were available. If you’re interested, by using the link below, you get 15% off a subscription.

Key insights under the hood

Notable developments

Adyen invested in products like Uplift to enhance cost, conversion, and fraud management for customers.(which of course increases authorization rates which is what their customers want. This is AI driven and I believe Adyen is one of the first to have found a positive ROI use case to AI)

Continued investment in Intelligent Payment Routing Debit in the US, where they see an increased demand in the debit route payments

Their single platform and data-driven approach are increasing their share of wallet with existing customers.

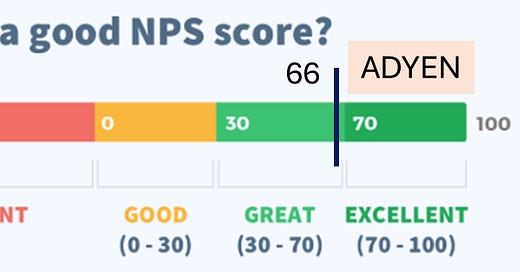

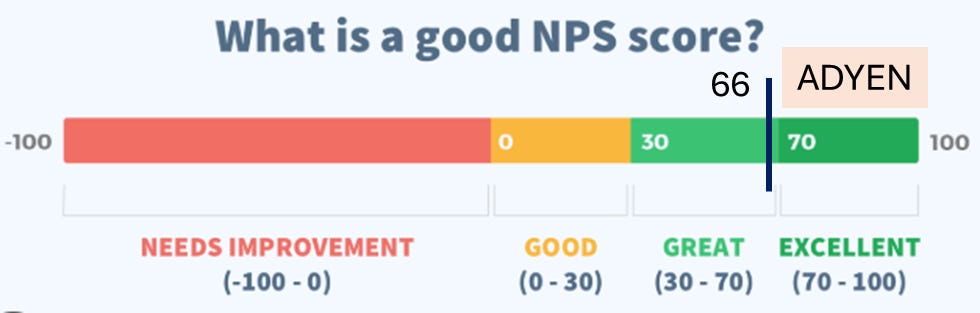

Adyen achieved an all-time high Net Promoter Score of 66, indicating strong customer appreciation. (NPS measures the loyalty of a customer to your service/product) In case 66 does not mean anything to you, here’s what that score looks like on a scale:

Successfully processed 60,000 transactions per minute during Black Friday/Cyber Monday, showcasing scalability.

Experiencing growth in digital, unified commerce, and platform merchant pillars with clients like Adobe and MotorOne.

Plans to invest in their team, particularly in North America, while aiming for EBITDA margin expansion in 2025. (which is positive as margins decreased in the past due to hiring. This means they expect margins to expand regardless)

Expects net revenue growth to slightly accelerate in 2025 compared to 2024.

Seeing good traction in issuing and capital products within their embedded finance offerings.

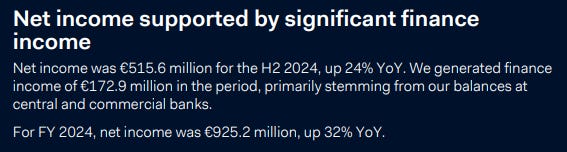

One of the key aspects, and often forgotten, is the significant finance income (from their balance sheet) that Adyen generates each year. I don’t think anyone will forget it now as it has been explicitly stated in their half year report:

CAPEX remains in line, at a modestly low 5% of net revenue (their main expense is their staff)

Free cash flow amounted to 860 Million which represents a 34% increases year over year

By business segment

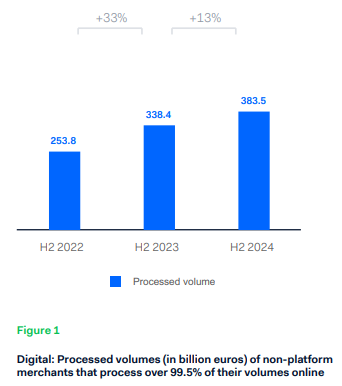

Digital

This is where it all began for Adyen, in pure digital payments. As mentioned before, they are using Uplift-AI to improve authorization rates for their clients, which shows that even in the most established branch of the business, innovation still continues.

However, growth has been less strong as compared to the previous half year:

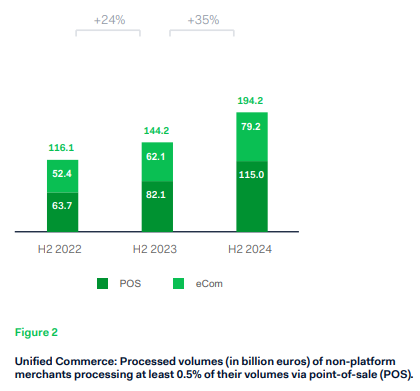

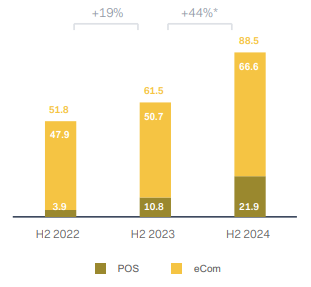

Unified Commerce

This is about embracing the omnichannel solution, where merchants can have different payment possibilities for their clients.

This segment experienced significant growth (35%) in H2 of 2024.

Platforms

Here Adyen combines their know-how in Digital and Unified Commerce and offers a unique solution to marketplace and businesses that run platforms.

This segment is growing the fastest in processed volume(Billion Euros)

Conclusion

As I mentioned in the deep dive, Adyen is a unique company with a unique culture. It has a long-term view and the operational excellence to execute on their plans. They do whatever they can to avoid becoming a commodity product in payments(which is not easy to do). They provide solutions to their customers that are priced higher than their competitors, but in exchange provide more value to the customer. Due to the increasing complexity of payments, and their expanding regional reach, Adyen is continuously strengthening its moat.

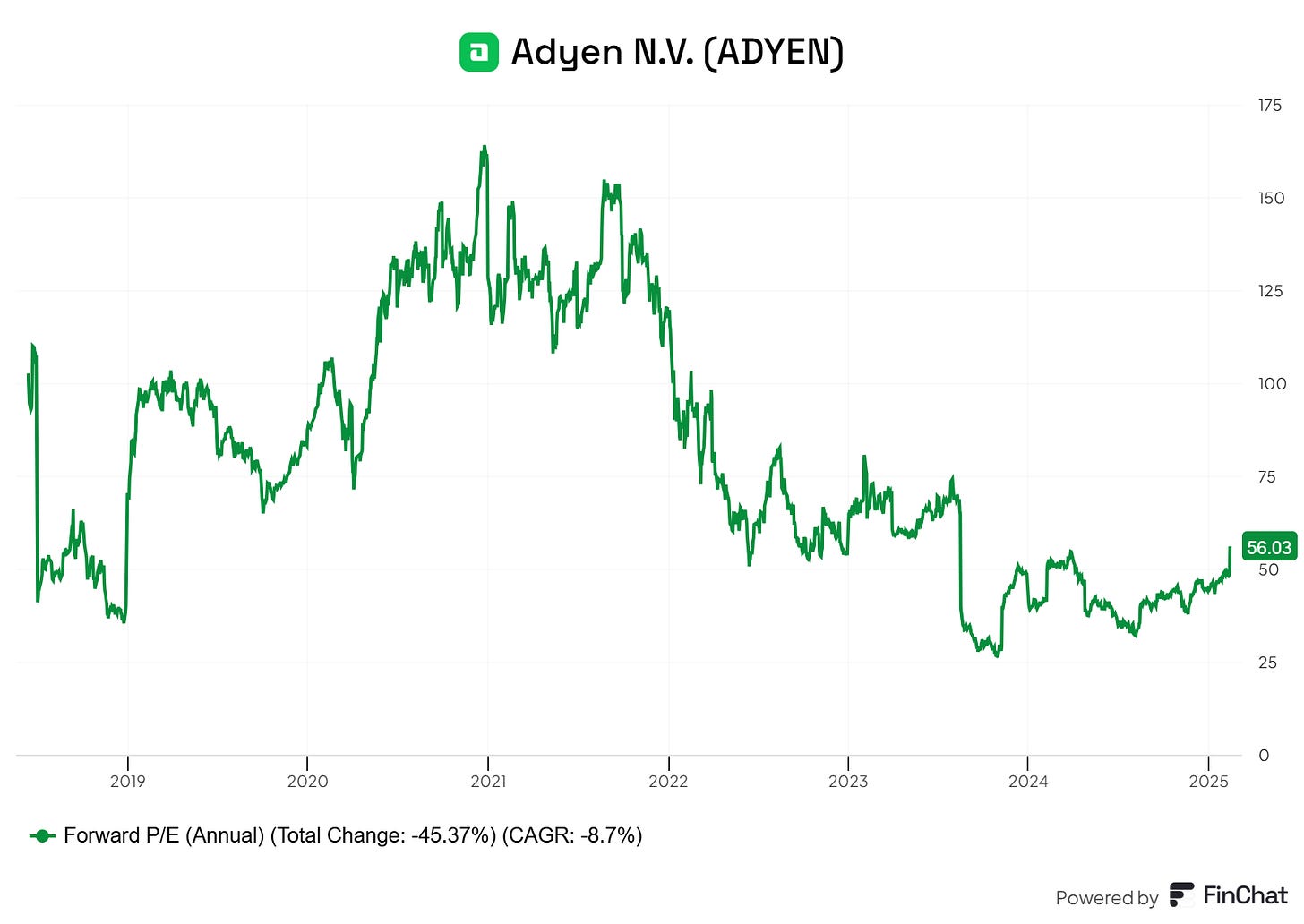

When looking at pricing, current forward P/E sits at 56.

In other words, a high quality company trading at a high price.

I hope you enjoyed this earnings report.

Let me know how I can make these better!

May the markets be with you, always!

Kevin