Imagine it's tax season.

Your business is being audited.

You are asked for a receipt from three years ago, for a payment made to a vendor you vaguely remember.

You search through your piles of paper and folders of digital files, but you can't find the receipt.

You check your email inbox, but the relevant message is buried among hundreds of others.

You start to dread facing penalties, fines, or worse, for not having proper records.

Okay, that was probably a bit extreme. But I think you get the point. :)

If you're a business owner, this scenario is all too familiar.

Tax season can be stressful, not only because of the deadline pressure and the complexity of tax rules but also because of the burden of record-keeping.

Keeping track of receipts, bills, invoices, and other documents is crucial for accurate accounting, but it can also be a time-consuming, error-prone, and frustrating task.

It's not uncommon for business owners to resort to shoeboxes, envelopes, or spreadsheets to manage their receipts, or to rely on memory, guesswork, or luck to find a particular record when needed.

The problem with such ad-hoc approaches is that they can create various issues, risks, and costs for a business.

No Process in Place = An Open Invitation to Problems and Risks

Without a set process in place, business owners may:

Miss or lose receipts, leading to incomplete or inaccurate records, and potentially triggering penalties, fines, or audits from tax authorities.

Waste time and energy searching for receipts, causing delays, stress, and distraction from core business activities.

Face reputation damage or legal liability if they cannot prove the legitimacy of their expenses, or if they mix personal and business expenses, for example.

Incur opportunity costs or missed deductions if they don't capture all the eligible expenses, or if they fail to reconcile their accounts regularly.

These risks can be especially daunting for small businesses, which often have limited resources, expertise, or technology to handle accounting tasks.

However, the good news is that there is a simple and powerful way to reduce these risks, save time and energy, and stay compliant with record-keeping requirements:

this is the part where you say thanks to automation.

By using simple tools to automate the collection, organization, and archiving of receipts, business owners can streamline their workflow, improve their accuracy, and focus on growing their business, rather than worrying about tax audits.

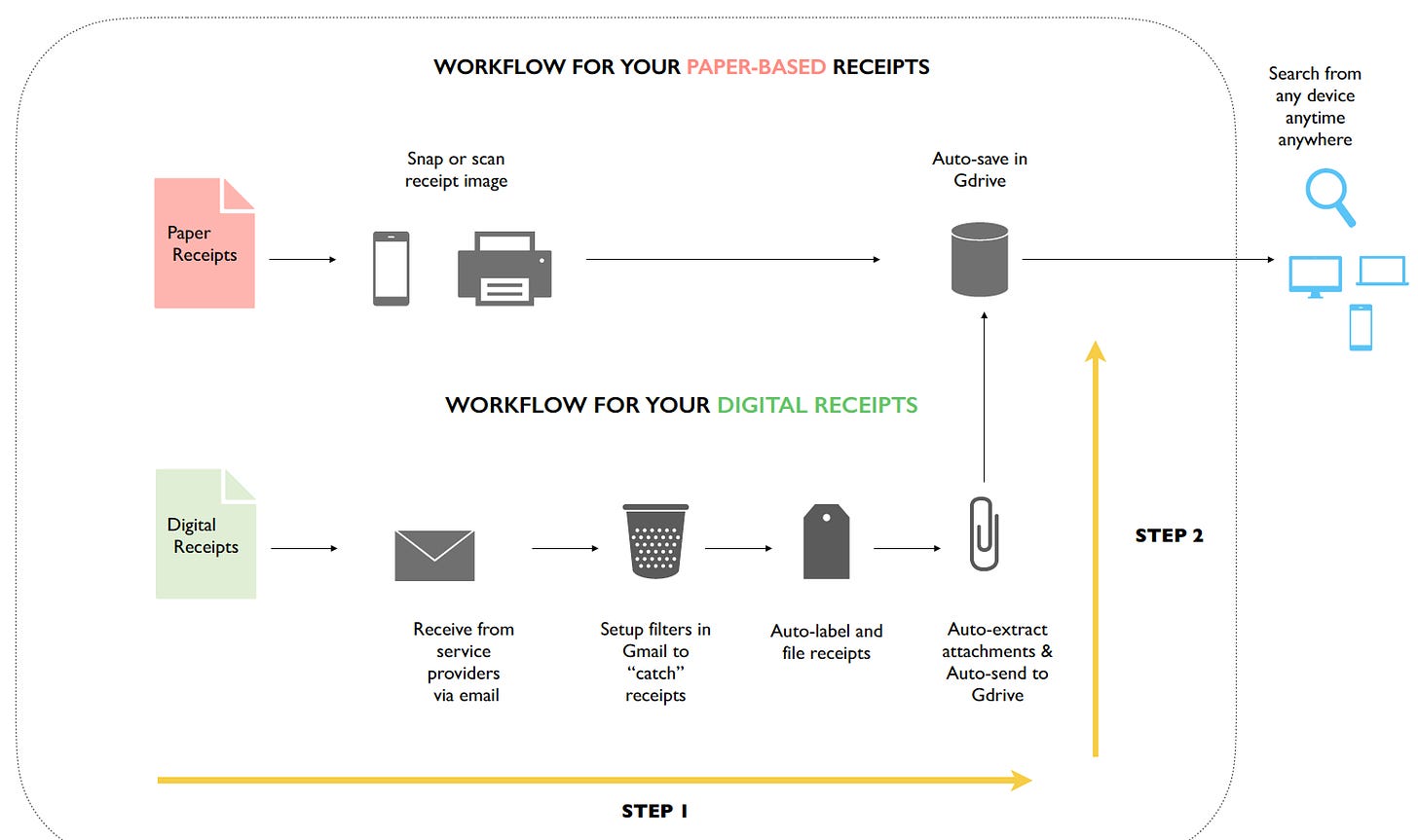

In this newsletter, I'll show you how to implement 2 SIMPLE automation steps that will help you manage your receipts received via email.

The workflow I discuss in this newsletter is incredibly simple to set up, and it only takes a few minutes.

By setting up quick filters in Gmail to automatically file emails from service providers, you'll be able to keep all your bills and receipts organized in one place.

Additionally, by automatically moving attachments like PDFs from emails to Google Drive, you'll never have to worry about losing or misplacing a receipt again.

In the next issue, I'll cover how to handle paper-based receipts.

Next week's newsletter will cover how to set up a workflow to move paper-based bills/receipts captured via a smartphone/scanner to Google Drive, which will make the process even more robust.

With these three steps, you'll have a robust and hassle-free process in place, and you'll be able to sail through tax season with ease.

By implementing this three-step workflow, you'll have a set process in place to keep you organized, mitigate risks, and ensure compliance during tax season.

Without further ado, let’s jump right in.

2-Step Automation Recipe To Organize All Your Electronic Receipts [31-Min Video Below]

Apps Required

Gmail

Make (free plan available)

Downloads

Simple End-to-End Process Flowchart

Note: If your business does not use Gmail, please comment below. I’ll make a separate video if you’re using other email service providers such as Outlook, Zoho, etc. Also, you can use Zapier instead of Make. But I find Make’s free plan to be WAY better than Zapier’s paid plan.

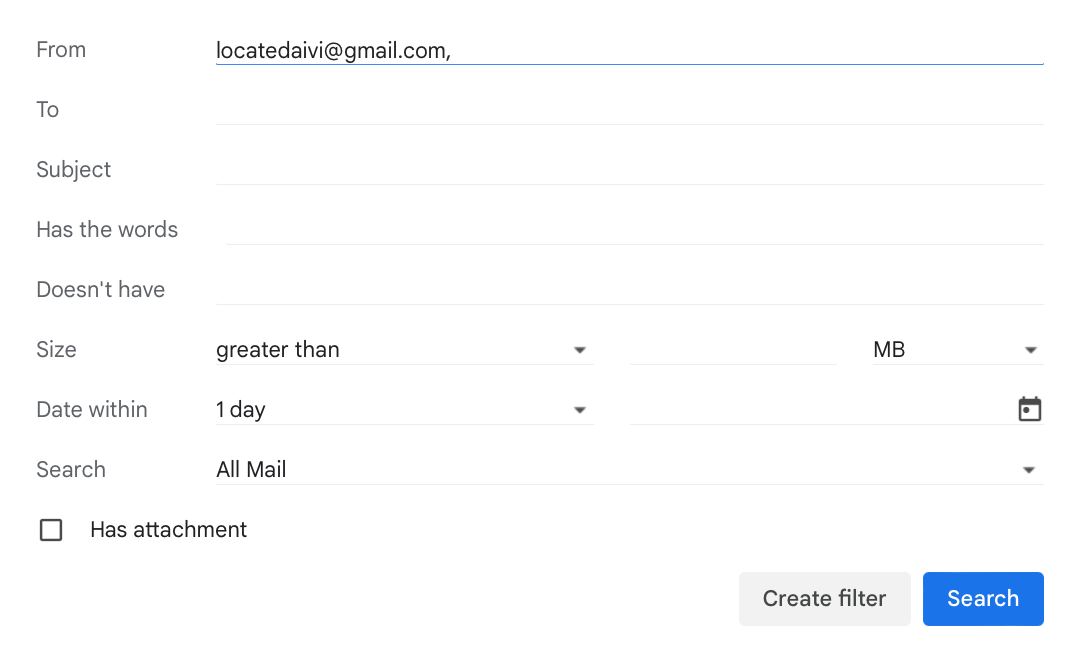

STEP 1: Setting up Quick Filters in Gmail to Automatically File Emails

Open Gmail and log in to your account.

Go to the search bar at the top and click on the drop-down arrow on the right side.

In the "From" field, enter the email address of the service provider whose emails

you want to filter (e.g., your internet service provider, phone company, etc.).

Click on "Create filter" at the bottom right corner of the search bar.

In the "Filter" window, select the actions you want to take on these emails (e.g., mark as read, skip the inbox, etc.)

Check the box next to "Apply the label" and select the label you want to use (e.g., "Bills", "Expenses", etc.).

Click on "Create filter" to save your settings.

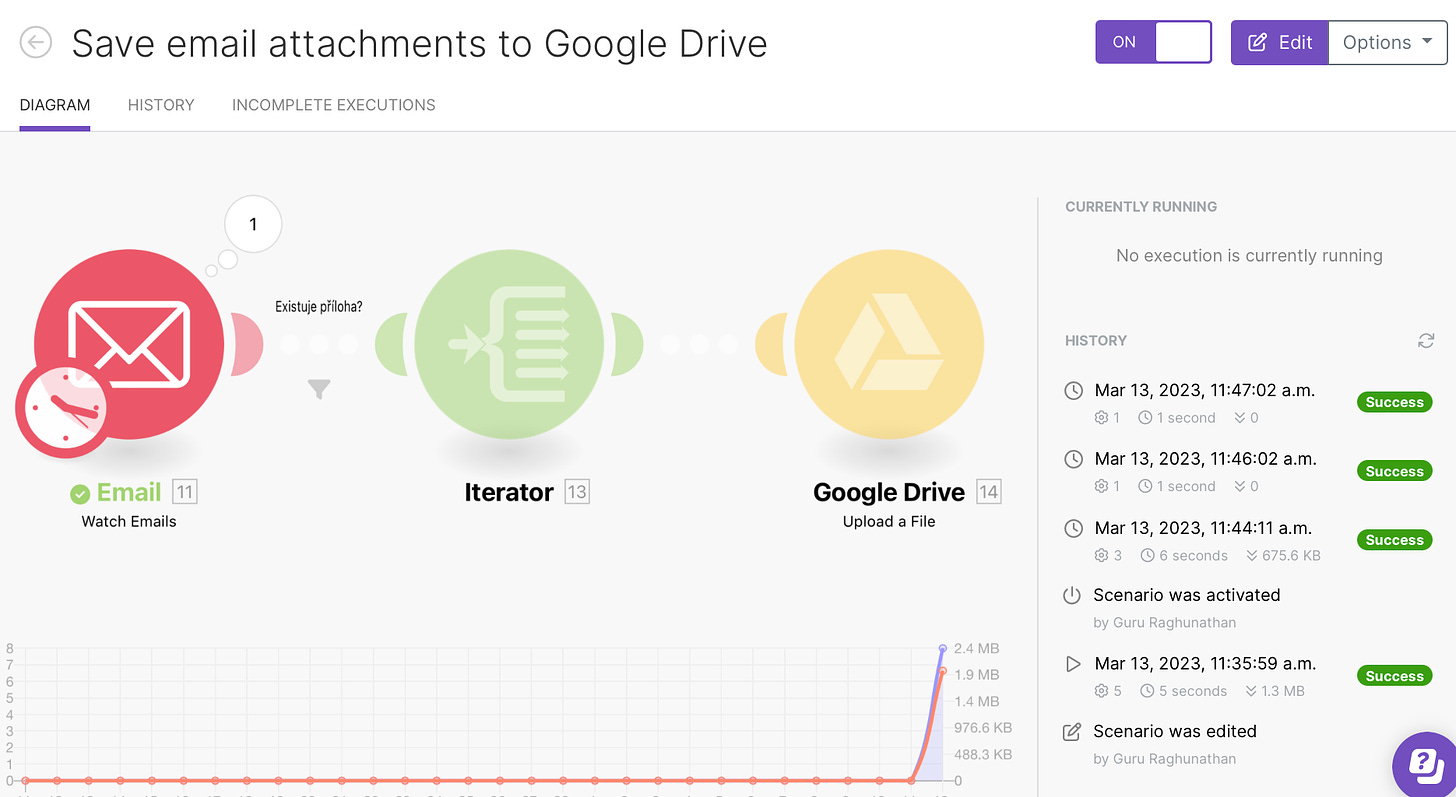

STEP 2: Automatically Moving Attachments from Gmail to Google Drive Using Make.com

Now that you have set up your Gmail filters to automatically label and categorize your receipts, it's time to automate the process of moving them to Google Drive.

To do this, we'll use Make.com, a free automation tool that allows you to create custom workflows with pre-made templates.

Here's how to set it up

Sign up for a free account at Make.com and navigate to the "Gmail to Google Drive" template.

Click on the "Use Template" button to create a copy of the workflow in your account.

Authenticate your Gmail and Google Drive accounts so that Make.com can access them.

Customize the workflow to your liking. You can choose to save receipts to a specific folder in Google Drive, add the date or vendor name to the file name, and more.

Save the workflow and turn it on. Make.com will now automatically move any receipts that meet the criteria you set up from Gmail to Google Drive.

Conclusion

Implementing a simple automation process for managing receipts during tax season can save you a significant amount of time and energy.

By setting up quick filters in Gmail to automatically file emails from service providers and using Make.com's pre-made templates to automatically move attachments from emails to Google Drive, you can ensure receipts are organized and easy to locate when needed.

Additionally, by staying compliant with archiving requirements and keeping accounting books accurate and up-to-date, businesses can mitigate risks and avoid potential fines and penalties from audits.

With just a few minutes of setup time, you can make your tax season experience much smoother and stress-free.

What to expect in the next issue?

As mentioned above, Step 3 of this automation process involves setting up a workflow to handle paper-based receipts.

While steps 1 and 2 focus on organizing digital receipts received via email, step 3 will take care of paper receipts captured through smartphone scanning or digital scanning.

Once you have scanned a receipt, you can set up a workflow to automatically move the receipt to Google Drive or other cloud storage.

This final step will complete the automation process, ensuring that all receipts, both paper-based and digital, are stored in a secure and organized manner.

With this complete automation process in place, you'll have a solid system to manage your receipts throughout the year, and you'll be well-prepared come tax season.

So, be sure to stay tuned for the next issue where I’ll dive deeper into Step 3 and provide you with a detailed guide on how to set up a workflow to handle paper-based receipts.

If you liked this article or found it useful, please comment below. I’d be honoured.

Do you have a business problem you’d like solved through automation? Let me know, and I’ll dedicate an article for you with a working solution.

ESCAPE Tax Season Craziness. Setup This DEAD SIMPLE 2-Step Automation To Organize ALL Your Receipts [Part -1]