Not Your Keys, Not Your Coins v2.0

For many in the crypto community, the last 18 months have been a tumultuous journey. Many long-term holders have endured volatility before, but the Spring and Summer of 2021 undoubtedly kickstarted a hellish bear market. This market - filled with the usual amount of uncertainty - was still quite unique in its own right. Most notably, a seismic shift in Bitcoin hashpower began in May of 2021, during which roughly 50-60% of Bitcoin's computational power poured out of China. The price of Bitcoin (BTC) then experienced swings of ~40% in the span of days or weeks, demonstrating volatility the likes of which we had not seen since the 2017 bull run.

Still, the Bitcoin network proved resilient in the face of major migrations, bolstering its claim as a decentralized and secure monetary network. Despite the looming bear market, some remained incredibly bullish. Companies like MicroStrategy, for example, was investing hundreds of millions of dollars in BTC. Under this light, the digital asset landscape was looking more stable and secure, making it palatable for investors of all kinds.

Of course, market cycles do exist, and the Bitcoin Halving is a key part of that. But just like in 2017, many arrived late to the party in 2021 and locked in severe losses. Around the same time, some holders were staying in the game with serious conviction, locking up their Ethereum on-chain prior to its migration to Proof of Stake. Then, at an uncertain point, the 2021 correction caused a shift in investor thinking.

In droves, retail investors sought refuge in stablecoin banks. Others placed their BTC and ETH into platforms for percentage yields in the mere single digits. Everyone wanted to earn while they waited on the sidelines. This trend rapidly normalized yield-seeking behavior, building a pyramid of liquidity pools with low-to-no oversight. Under this new normal, investors unwittingly exposed themselves to counterparty risk at a level never before seen. And the kicker? This was all done in an ecosystem that should’ve read the tea leaves of impending collapse.

Indeed, there were some signs, and then those signs turned into waving red flags. As firms like BlockFi agreed to pay regulators $100 million, the company was slowly reducing the yields in the name of "sound risk management". In Mid 2022, Voyager Digital even suspended customer withdrawals, later seeking out firms who could absorb their losses. And in spite of ongoing litigation, Voyager customers have only just received ~35% of assets back. As a stark example of this pyramid of illiquidity, the now-defunct FTX actually had plans to buy Voyager Digital.

Still today, the saga continues for those with funds frozen in the Gemini Earn program, who are collectively owed ~$900 million. Any investor with funds locked up, whether it's $1000 of BTC or $100k worth of USDC, has a daily reminder of the lessons taught by Satoshi Nakamoto's staunchest fans. Trite but true, conventional wisdom has always been Not Your Keys, Not Your Coins. It has been repeated so often that it must be considered dogma.

With untold losses too many small fortunes to count, all too many have lost funds to theft, scams, centralized exchanges, forgotten memories, and simple human error. So now, there is another side to this coin. Many investors decided to promptly exit exchanges and move funds to cold storage, reemphasizing the importance of proper self custody. Just a few months later, many who had blind faith in cold storage have had their conviction shaken yet again, bringing us to version 2.0 of Not Your Keys, Not Your Coins.

Cold Storage - Maybe It's Not So Cold Anymore

In mid-May, Ledger announced a recovery feature for its hardware wallet that would allow a user to back up their seed to three separate companies: Coincover, Ledger, and EscrowTech, where each company secures one fragment of the encrypted pre-BIP39 version of your private key. To enable the feature, users must cryptographically sign from their hardware wallets in the same way they would send funds. Still, doubts about the security of the firmware, and fears of backdoors, thundered across the crypto community. This all came in the form of cries about censorship or potential seizure, where key custodians may be coerced by centralized agents of control. No matter where you land on this issue, it is true that having cloud custodians of your keys, whether divided or not, introduces very real attack surfaces.

The overall response has still been relatively mixed. Some took hammers to their Ledger device, and others silently reassessed their self custody practices. Some take the view that nothing fundamental has changed with respect to transaction processing or hardware. Others question manufacturer integrity and by extension the device itself. Sentiment from social media suggested that Ledger owners had an expectation that their keys could never be extracted from the device.

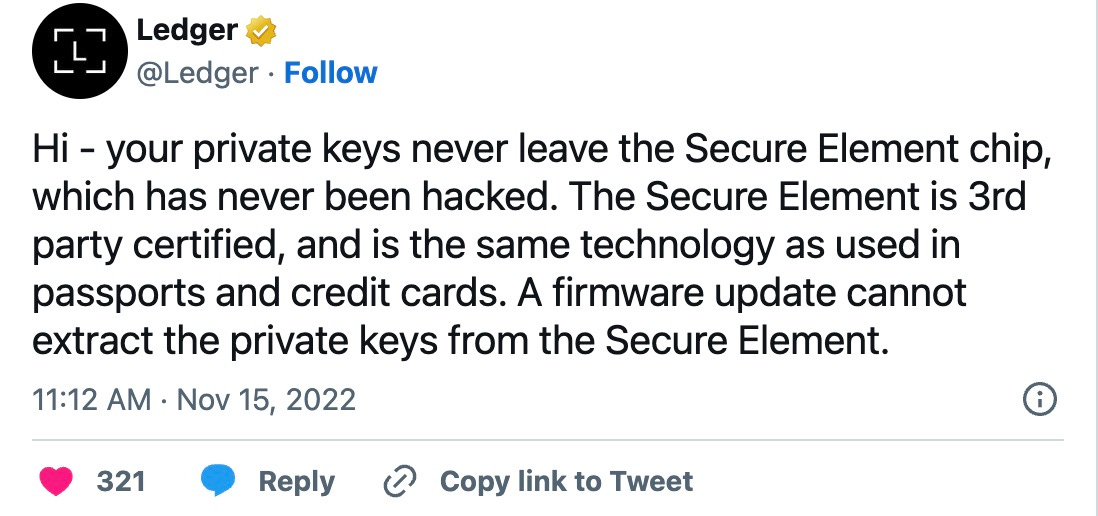

Many cited the Tweet above as the reason for their stance, while others may have been in denial of the fact that they trusted the manufacturer implicitly. Prior to this feature announcement, consumer opinion was that the Ledger wallets were a black box, and the device itself can only ever know the key. Community backlash then came in the form of demands for open-sourcing the code. Ledger rather swiftly rolled back their plan, releasing the Ledger Recover Technical White Paper and vowing to open-source code prior to the feature's release.

We don’t yet know how this will play out. What is obvious is that recent events have sparked a debate with some incredibly nuanced, albeit technical talks on what "trustlessness" practically means. This has forced many to ask the hard question: Is there a form of self custody that is truly free of trust?

To delve deeper into this, what follows is an article entitled The Paradox of Self Custody and Trust. It includes core concepts of cryptographic transactions, consensus, and trust. It examines the perils of taking full custody of digital assets, while comparing industry options to more “pure” forms of self custody. It will also take a clear-eyed view of how self custody methods can affect adoption. Feel free to like, share, or subscribe to spread the word!