On June 4th, we shared with paid subscribers the first installment of a new series we’re calling “In Conversation”, which highlighted the bull case on one of the most hated semiconductor names in the market.

These are transcripts of calls and conversations we have over the course of our research process and include talks with professional investors, industry experts and executives.

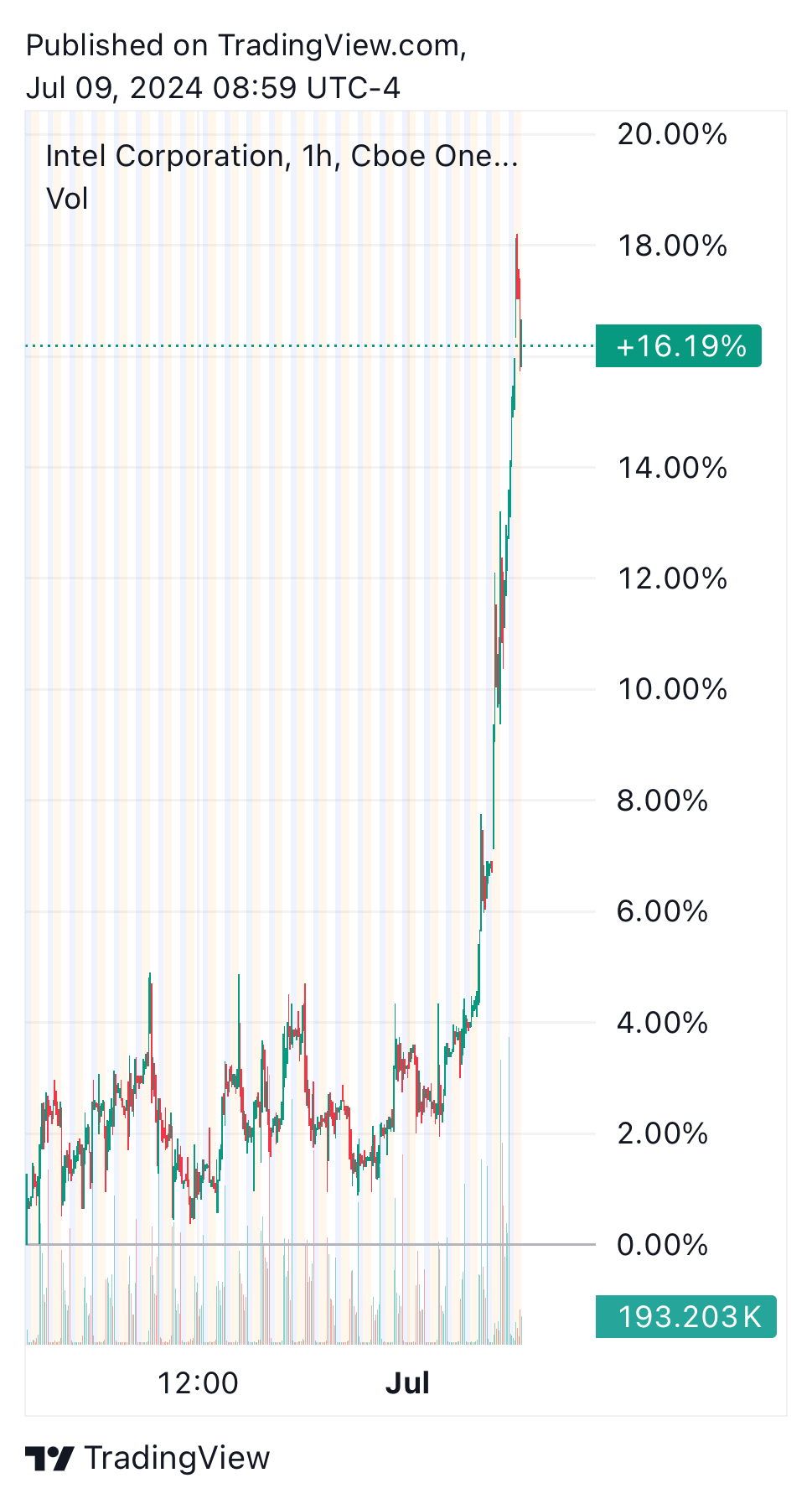

Since we originally posted, INTC has rallied more than 16%.

So I’ve decided to publish the transcript for all subscribers. Enjoy, and please consider upgrading to a paid subscription if you’d like to get these conversations as soon as they’re released.

In Conversation Series

Intel (INTC) Prospects: Hated Enough to Rally?

June 4th, 2024

00:00

Speaker 1 (Expert - Professional Investor)

One of two that have ribbonFET transistors. So I think honestly, , they will be at the leading edge in 18 months for 18A. And that alone is like enough of a big driver.

In 18 months we start seeing orders coming in or at least some yield improvement on guys coming out.

The market will have to price INTC like a true profitable IFS, which alone I think is worth $100 billion.

So - it's obviously not worth as much as TSMC, but a sum of the parts valuation, like, the fact that you have this stable leading edge fab in the US, like, that's got to be worth 100 billion.

And then it just becomes a question of like, okay, is if x86 is dying, but it's still giving you know, $60 billion a year in sales at a 50% gross margin.

00:52

Speaker 1

What do you value that at in a case like that? Nobody picks up on Gaudi and, you don't have a growth in market share being taken by the intel zone x 86s processors. That still to me feels like the existing PC server business. Even if it's not gaining market share, it's still worth like 40 to 60 billion. So you have a floor case where the company's worth at least what it's worth right now.

01:20

Speaker 2 (CitriniResearch)

Yeah.

01:21

Speaker 1

And then it's like… okay, great. You basically are getting a free call option because the company is correctly valued. If everything goes pretty wrong.

Yeah, well,, you're at that valuation right now. And then basically if one of three things happen, Nvidia starts producing lagging edge like, you know, like H 100s or H 200s with intel, which is unlikely, but that's one bullish scenario. The second bullish scenario is you actually have a bunch of take up on X. They steal market share from AMD, particularly just because I'm building on Genoa right now.

If you could steal market share for AMD, then the cpu part of the business goes from being worth like 60, I think, to at least like 120. Again, as much as AMD's worth gives a fuck about AMD graphics cards anyway.

02:11

Speaker 1

And then the third bullish case is like, actually the research on being flop to watts efficiency ends up continuing through the 18A process. And they come out with a gaudy that not necessarily competitive on a training basis with the B 200s, but it's competitive on an inference cost basis. And then that business goes from being worth four or $5 billion to being worth 30 to 40 probably.

And if you get any one of those bullish scenarios, the stock price should be sitting at 40. I think if you get two out of three, then you're looking at a $50 to $60 stock and it doubles from here. And , that whole confluence of things, it makes me quite bullish on the stock price but more just a feeling of asymmetry here that isn’t present in any of the other semi names save maybe TSMC.

02:56

Speaker 1

It's not going to go down that much further unless the market goes down. So just hedge it out.

03:09

Speaker 2

So you don’t think they disappoint on the timeline?

03:13

Speaker 1

Yeah, 18 months on 18A till you have dies flying out.

I think you start getting the first dies coming out 18A , target towards the middle of next year. That's really end of 2025, early 2026 that you see them just flying off.

03:30

Speaker 2

And you think they can do 2nm at scale?

03:33

Speaker 1

Yep. Yeah, everything points that way too, because Intel usually will lag a little bit, but in a manner where they are much more focused on yield.

That means that if they end up putting out to 20 nick, , you know, 20 nanometer, two nanometer, or 18A, they're going to be in position to ship it with high yield too. And that's the other component that I think people forget about.

Intel is…generally there are meters in yield on their line. So that's a huge bonus and something that TSMC's never had to deal with from a competitive standpoint.

04:10

Speaker 1

Now, you’re never going to see intel compete for Nvidia deals, but I think where you could see an Intel Nvidia partnership coming back is , I wouldn't be surprised if you end up in a world where, it's not just Dell, but also some of the other guys, entering the server rack space are exclusively doing on x 86s plus Nvidia.

You still need a cpu. No one's actually going to buy fucking grace offers from Nvidia.

04:37

Speaker 2

You think so?

04:38

Speaker 1

Yeah, nobody wants them. They're pushing, as an Nvidia customer room inception program. they're shoving Grace Hoppers down our throat. Nobody fucking wants them, right?

04:52

Speaker 2

But you're not bullish on AMD, then? I’m pretty bearish on AMD.

04:59

Speaker 1

I'm not bearish on AMD, because I think there still is a massive leg up in data center investment. I don't think it's gonna exist forever, but it's enough such that data center should be as big as PC by next year.

That's why people are still buying PCs. , there's more to go around for everybody. I think ARM is the real winner, but that's been priced in now. That was a great trade by Masa, but Arm was the clear winner here.

05:30

Speaker 2

Yeah. So what do you think on macro drivers as far as intel, PC cycle, automotive cycle. I think bottom on Automotive. I think PC still has some way to go.

05:44

Speaker 1

PC hasn't bottomed yet. Data center is so big and the upgrade cycles have gone down too on the data center side that , I think the combo of the velocity and data center should offset. Obviously what's going on with the PC market. It hasn't bothered yet. I don't think it's found its next kind of true median trend lines either. People are just buying less PCs.

06:14

Speaker 2

Yeah.

06:17

Speaker 1

Oh, the other wrench to throw in here is , I wouldn't be surprised if Apple, given that ARM is pushing some of their leading and stuff to intel. I wouldn't be surprised if intel and Apple start playing nice again.

06:35

Speaker 2

Really?

06:37

Speaker 1

Yeah.

06:38

Speaker 2

Why?

06:39

Speaker 1

Just for two reasons. I think the first reason is if this new arm architecture for the M5, which is what the M5 should be using, requires backside power delivery, then they're stuck between Samsung and Intel.

And Apple has an equal contentious relationship with both of those companies, right?

I think they would prefer to work with TSMC. But I think here the reality is, if Nvidia, if TSMC really comes in and says, we gotta double or maybe even triple our bus or die.

I just don't think Apple is gonna. Apple can't afford to bleed that much margin on their M chips. They can't because they can't increase the pricing on the MacBook Pros right now or else they seriously start to lose out to their own products and have a negative mix shift.

07:31

Speaker 1

And downsizing it's like Apple is much more sensitive to chip margin as well than Nvidia is.

07:38

Speaker 2

Right?

07:38

Speaker 1

Because Nvidia is 90% margin to play around with. TSMC could show up tomorrow and, I don’t know, quadruple the cost per die, and Nvidia is still stuck with them. I don't think Apple has that luxury, especially given how tight everyone's looking at net income now Apple, because revenues have stalled out.

08:01

Speaker 2

Yeah. So, like the simplest way you could put your thesis?

08:22

Speaker 1

I think the simplest I could put it is like, there's an edge from backside power that people aren't pricing in at all. I don’t see people talking about it except for Dylan and the semi analysis guys. Everyone just hasn't really been talking about, like, how big of a deal backside power delivery is. Talk to an actual semi designer and it's a. The amount of improvements that you could get on per watt efficiency from splitting data and power delivery is insane.

08:50

Speaker 2

RibbonFET and Backside Power Delivery combined. That’s good for the power efficiency concerns.

08:54

Speaker 1

So we're getting to the point now where the transistor gates are not actually getting that much smaller. The key differences between three and two nanometer are not that the transistor gates have gotten 50% smaller. They've actually gotten only about 10% smaller.

The key differences are the transistor design. So intel and I believe TSMC are switching to a RibbonFET transistor design, which is a three dimensional transistor, which is a huge deal. So, that's how you already know Intel's keeping up, is that they both are adopting the new standard

But, importantly, TSMC is not doing backside power delivery. It's only Samsung. Samsung's not doing RibbonFET. So intel's the only one doing both,

And I guess the market feels like intel has been saying a lot of stuff over the last three years. They won't take anything seriously until they see it. But I think once you have a demonstration of a ribbonFET set and backside power delivered chip going to an end customer that is not intel stock should reread like that. To me, feels like enough for the stock to re rate.

I'm just being super conservative on, like, all the other scenarios and assumptions that need to go through for this to be a good trade.

There's a universe where they, say, have an investor day, they demonstrate they're the only ones in the world doing this and they’ll be key in power generation concerns abating.

They focus and shift the focus entirely to efficiency and I think the market, as we talked about yesterday, if the constraint is power, then that is the correct thing to be architecting towards.

10:29

Speaker 2

Yeah, I mean, that's, that's interesting because I only hear people talk about, you know, Nvidia being the ones that kind of take us, you know, from this power constraint. But I never heard intel talk about it that way.

10:43

Speaker 1

Yeah, yeah. I mean, I think the reason why you don't hear intel talk about it that way is like, truthfully, Gaudi sucks in terms of integrations, right?

Like, yes, it has Pytorch, but like, really, Cuda is what's holding that whole chip. So it's really going to take Intel not only, you know, working on X 86, which is what X 86s is, but it's really going to take them, like, continuing to build their own version of compilers and, you know, like on chip software.

It doesn't have to compete with Cuda, but it's just got to be fucking better than what exists right now, where it's like a pain. It's just a pain the fucking ass to get it to work. Yeah, I mean, especially in clusters at scale.

11:25

Speaker 2

Do you have any idea what disrupts Cuda?

11:29

Speaker 1

No, but…Well, I've got one idea. I mean, Triton is possibly like, Triton coming out. Open AI, which is an open source GPU software. Possible. It's possible because theoretically, Triton should be composable to any chip because it's not architecture specific. And OpenAI is using Triton instead of Cuda, to be clear, which is, I think something that's under talked about is that, you know, GPT four was trained on a 100s running Triton, not Cuda.

12:04

Speaker 2

Didn’t know that.

12:06

Speaker 1

Yeah. Yeah. So I think a lot of like, to me, a lot of this trade, it's like everything has to keep staying the way it is for Nvidia to trade where it is and less so about, like, that stuff, like, less so about intel just because it's such a value play. But that stuff obviously does affect intel too. Like, if Nvidia starts bleeding at all on. On GPU's, like it does, it just doesn't make sense as a $300 company.

12:30

Speaker 2

Yeah, yeah. It’s definitely asymmetric. Maybe not as asymmetric as memory - that's where I'm most bullish right now I think.

14:29

Speaker 1

Oh and I think the other big thing as to why I would own intel versus anybody else is you know they're going to be in the next, fiscal package.

14:41

Speaker 2

Well micron to kind of, yeah, micron.

14:45

Speaker 1

Not to the extent of like I really think if Patty G went to either administration and said hey I want to actually build another 18 a node, I need you guys to back stop at least alone get it in 2 seconds. Right now.

14:58

Speaker 2

Yeah, yeah. I mean the, what do you think? Have you thought about at all about like the idea of like maybe China makes asics?

15:10

Speaker 1

Yeah, I think they're going to make it at home though.

15:14

Speaker 2

Yeah, exactly. True. I think so too. But then you get the question of like okay, like they're probably not gonna make an ASic that like beats Nvidia's most advanced chip. But if they make one that's better than what we're allowing them to buy.

15:31

Speaker 1

That is bad for Nvidia's A100.

15:36

Speaker 2

Yeah. And then, and then does China keep it to themselves or do they sell it on the market?

15:42

Speaker 1

Well here's the thing. If you sell it on the market, you're gonna run into the same problem until running into, like, there's no way it's gonna run on CuDA and there's no way it's gonna run on something that's as extensible as CuDA is. So, like, I'm not worried about them stealing any, like literally any market share outside. Because like the advantage to CUDA is that like the same instance that's training a graphics card can also do, or the training a generative model can do inference, can train a tree can train any number of, like, you know, like people are still running like RNN's for recommenders. Like all that stuff still has to run on GPU's, right? Like that's why meta bought all the h 100. So it wasn't for their AI research, it was for RNN's on their graph to improve the recommender algorithm.

16:27

Speaker 1

RNN's are still fucking costly to train with that much data. And so having a system that can do all of that is what makes Nvidia so active to a hyperscaler or to an OpenAI that might be experimenting with different architectures other than a transformer.

For example, as recently as 2020, OpenAI was still publishing the research on LSTMs which are long term, short term memory models which don't perform as well at all on like textual tasks, but for example, perform way better on context awareness tasks.

Recommender systems like the model that beat those guys in Team Fortress two, or on like Overwatch. Like that was an LSTM model.

17:21

Speaker 1

I also think there's this other potential thing that's brewing which is everyone has become so fixated on one very specific architecture that's good at a couple of tasks. But I actually don't think that is the architecture that is going to resolve AGI.

It might be a bunch of LLMS to talk to each other, I don't know. But there is another architecture which might require different kind of optimal chip construction to train. But the thing that I do know is that whatever that architecture is, like, the way Cuda is written, that is one attractive part about Nvidia that Intel is going to have to catch up to is like, the current architectures they have are great for most use cases and are optimized on software for most use cases. And that's something to just, you know, look at.

18:09

Speaker 1

And then the other thing that's like, just the thing we didn't talk about, the hyperscalers are all building their own chip, right?

Amazon's got whatever the fuck they're doing. Microsoft's also building something as well. Apple obviously is not a hyperscaler, but will be one, at least internally, pretty soon. Like, all those guys aren't going to be able to bid for TSMC die space. They got to make it somewhere. And Microsoft's already said they're going to go with intel. So, like, there's a lot of demand that can come in for the foundry services. And if that just comes into play, like, the stock has to re rate. It just doesn't make any sense. They just need some wins because the market seemed to be very distrustful of Patty. Yeah, there's enough there in the chamber.

18:58

Speaker 2

Yeah, I think I like your thing about the ribbonFET, backside power delivery thing. That seems like I can definitely see that happening. Like, it's like an investor day demo and then just fucking markets. Like, oh, wait, we like intel again. I feel like that.

19:12

Speaker 1

I know. I'm, I'm kind of waiting for that. I just don't know when that's gonna beat. But I almost think, if Pat's looking at the stock price at all, which he has to be. It has to happen before the end of the year.

And they're already working on yield improvement on backside power, not ribbonFET yet.

They did have a demonstration of ribbonFET, but they get a demonstration going by the end of the year. Like, with an investor day. That could be the catalyst.

19:38

Speaker 2

Very interesting. Thanks for the viewpoint.

19:44

Speaker 1

You're welcome. I'll leave you with a thought on NVDA here, which is my ultimate kind of long term bearishness. It's not about valuation, it's about the.

20:53

Speaker 2

I already know what you’re going to say. It’s about the fact that, like, your margin is my opportunity. But the margin is so

20:56

Speaker 1

Yes, exactly. And number one, it's like, one day, Taiwan semi is gonna wake up and just be like, give me 4000.

21:04

Speaker 2

Yeah, I mean, I think that. Nvidia is basically front running that, right? I think, like, Jensen coming out and being like “hey, yeah. you know, TSMC should charge more.“ I think he's basically saying, like, I'm gonna hedge myself against them just springing on me, “hey, guess what? It's 4000 to die”. And preemptively negotiate something where it's more reasonable for NVDA, you know?

21:25

Speaker 1

Yeah, exactly. Which, like, ultimately isn't that painful then. But like you said, it's super bullish to TSMC.

22:24

Speaker 2

Yeah, good to be long both if you’re long Nvidia. Cool. I'll see you later, thanks again man.

<End>