Good morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets in the day ahead. Today is Thursday, Sept. 21, a day when we are left pondering the latest hawkish move by the US Federal Reserve.

State of Play

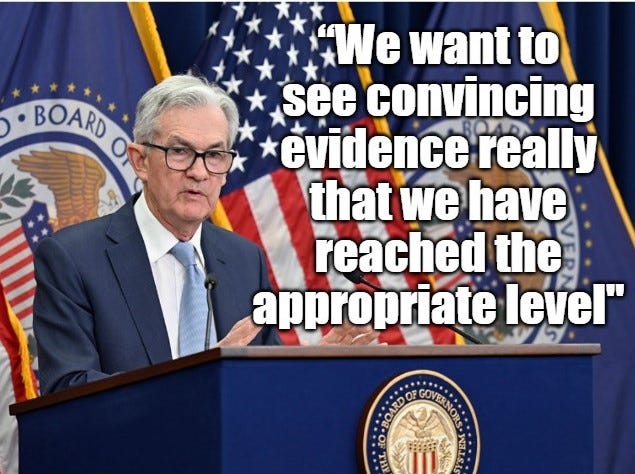

The Federal Reserve yesterday kept its key interest rate unchanged as expected but made enough noise about “higher for longer” to scare investors. Stocks and bonds sold off. Those fears only appear to have intensified overnight. As of 0635 we are looking at risk off across the board:

Stock index futures are pointing to a lower open, with the Nasdaq down 0.8% and S&P 500 down 0.6%;

Commodities are selling off. Copper is down 2.5%. WTI crude oil is down 1% to trade below $89/barrel;

Bonds are continuing to sell off as well, with the yield on the 2-year up another 3 basis points to 5.15%. You have to go back to 2006 to see the 2-year at that level. The yield on the 10-year is up 8bps to 4.43% (yields move inversely to prices)

Listen to this episode with a 7-day free trial

Subscribe to Contrarian Investor Premium to listen to this post and get 7 days of free access to the full post archives.