Good morning contrarians! It is Thursday, Jan. 12.

Stocks rallied again yesterday, with the Nasdaq booking the most gains (+1.8%). The S&P 500 was also up over 1%. Again no catalyst for the move as there was very little in the way of new information for traders to work with.

State of Play

As of 0625 all is quiet ahead of the CPI report at 0830:

Stock futures are flat. No movement beyond 0.2% of the break-even point to report;

Commodities are mixed, with WTI crude oil gaining ground again, up 1% to trade around $78/barrel. Copper is down <1%;

Bonds are unchanged. The 2-year yield is 4.22% and the 10-year 3.52%.

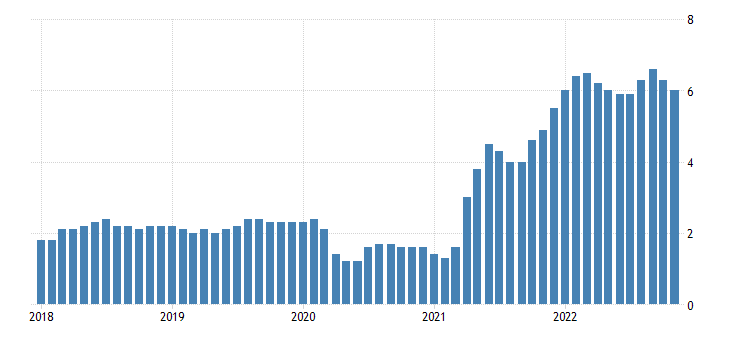

Consumer Price Index

The first inflation reading of 2023 is upon us. The US Bureau of Labor Statistics releases the CPI for December at 0830. Economists expect the headline number to come in unchanged month-over-month but the core CPI, which excludes food and energy, is expected to rise by 0.3% MoM. Last month those figures were 0.1% (headline) and 0.2% (core). The year-over-year figures anticipated are 6.5% (headline) and 5.7% (core). Last month they printed at 7.1% and 6.0%, respectively.

Listen to this episode with a 7-day free trial

Subscribe to Contrarian Investor Premium to listen to this post and get 7 days of free access to the full post archives.