Good morning contrarians! It is Thursday, Nov. 3.

Stocks cratered yesterday after comments from Federal Reserve Chair Jerome Powell that dashed hopes of a ‘Fed pivot.’ Tech saw the worst of it with the Nasdaq giving up 3.3% on the day — all of it in the last hours of trading. The S&P 500 sank by 2.5%. Dow Industrials dropped 1.6%.

The Fed

The FOMC event got off to a fine start, with some new language added to the policy statement, that the Committee would take into account “cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

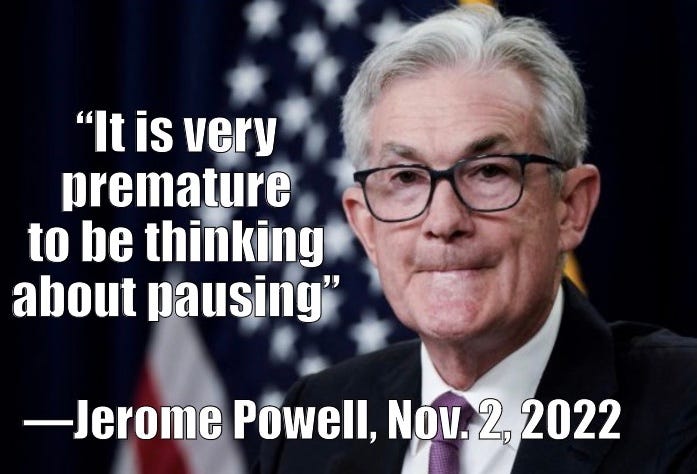

Investors initially took this as the long-awaited ‘pivot’ signal and bid up stocks. That lasted for about an hour until about halfway through Powell’s press conference when he announced it was “very premature to be thinking” about pausing rate hikes.

“People when they hear ‘lags’ think about a pause,” Powell said, an apparent direct reference to the new sentence in the policy statement. “It is very premature, in my view, to think about or be talking about pausing our rate hikes,“ he added. “We have a ways to go.”

Listen to this episode with a 7-day free trial

Subscribe to Contrarian Investor Premium to listen to this post and get 7 days of free access to the full post archives.