The First $100k Is A B****

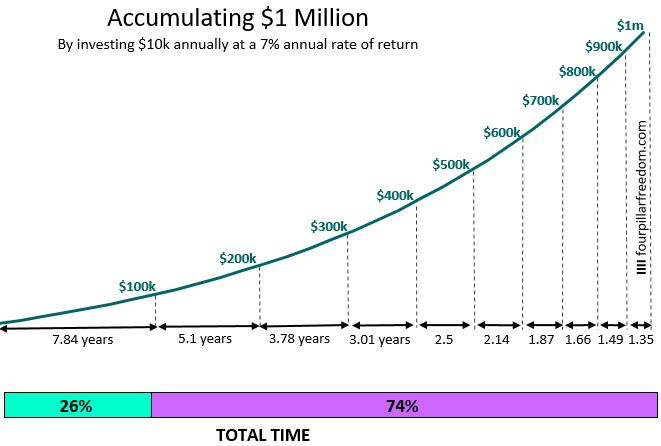

During a Berkshire Hathaway shareholder meeting in 1998, the late Charlie Munger said, "The first $100,000 is a b****, but you've gotta do it.” With an estimated net worth of $2.6 billion when he passed, Munger knew a thing or two about building wealth. He also knew that the power of compound interest can cause a small amount of money to gradually grow into a massive amount of wealth over time as gains are reinvested.

But is $100k in 2025 still the same starting point for wealth as it was in 1998? $100k in 1998 is worth $193,622.70 in today’s dollars.1 With skyrocketing home—and egg—prices, it’s more important than ever to get to a healthy baseline of financial health to set you up for success in the future.

But what if your goal isn’t just to get the snowball moving. What if you goal is to accumulate the amount of wealth needed to live without having to work.

How To Never Have To Work Again

One thing is certain: the faster you accumulate wealth in assets, the faster it will generate enough passive income replace your own income from a day job. To Munger’s point, this is in part due to the compounding interest your investments earn over time. If your goal is to never work again, you should aim to have 25x your annual expenses in a growing investment portfolio. For example, if your goal is to live on $80k/year;

You would need $2M in an investment account, ideally earning 7% annually.

With the 4% rule, you should be able to withdraw $80k/year, without ever touching the principal, since you will only be withdrawing the gains.2

The most interesting phenomenon of all of this is that the closer you get to your 25x number, the more in control you will feel. Rather than signing into work because you have to, you sign in because you get to. You’ll be actively choosing to work because it’s a way to be creative, work hard, and contribute to something meaningful.

If you don’t have those things in your work, you should feel the freedom and empowerment to make a change. While you can make this change without having hit your freedom number, the closer you get to it, the more autonomy you’ll feel in your working life. If you’re in your 20s, the key is to get started now by sprinting toward where you want to be.

Start Fast, Coast Later

When I ran track & field in high school, we often had to do cross fields. These were long repeat sprints diagonally across the entire football field. Our sprint coach timed us so that there was no dogging it—it was an all out sprint for all 110m+. And in May, as we entered post-season the humid, muggy, Ohio days made these extremely sh*tty to do. But I learned a valuable lesson that’d serve me well in my conditioning test when I played Division 1 college football, and now building wealth.

It’s easier to start fast, and coast through the finish than is to start slow, and rush to the finish to make time.

Build Wealth Fast, Coast Later

So far, this principle has served me well in building wealth. It taught me that when it comes to wealth-building, it’s far easier to sprint out of the gates. By intensely focusing on maximizing income, minimizing expenses, and investing the rest, I’ve reached Charlie Munger’s updated $200k in investments ASAP.

I don’t know how it feels to be playing catch-up on your financial life at age 50, but I can tell you that I never felt like I was missing out on anything. Even though I was financially disciplined, I was able to backpack through Europe, take three trips to Big Bend National Park, eat out often with friends—mostly at Juan in a Million or Terry Black’s BBQ—visit Egypt and Greece, try and fail at starting a hot sauce business, and pay for a wedding.

If you’re young and trying to sprint out of the gate ASAP, then you’re in luck because time is on your side. The first step is to get your income up.

Grow Your Income

Naval Ravikant is the co-founder and CEO of AngelList, a company with a $4 billion valuation during a 2022 fundraising round. He’s made early-stage investments in Uber, FourSquare, Twitter, Postmates, SnapLogic, and Yammer. On his podcast and personal blog, Naval often shares his thoughts on how to get rich.

“The Silicon Valley startup model tends to work best. It’s not the only way, but it is probably the most common way [to get rich], when you have two founders—one of whom is world-class at selling, and one of whom is world-class at building.” — Naval Ravikant

When you start from zero—without a trust fund or family business to inherit—the best way to grow your income is through a career in sales. Ideally, in an industry where the average deal size is substantial—$100k+ ARR—like tech sales or commercial real estate.

It’s completely fine to start at the bottom of the totem pole with less glamorous sales jobs. I did. My first sales job was at OrderUp, a food delivery service that was eventually acquired by GrubHub in 2017. Most of my work involved handing out flyers to generate leads while the Account Executive closed deals. It wasn’t glamorous, but it was a start.

“Selling has a very broad definition. Selling doesn’t necessarily just mean selling to individual customers. It can mean marketing, communicating, recruiting, raising money, inspiring people, or doing PR. It’s a broad umbrella category.” — Naval Ravikant

To Naval’s point, sales is a broad definition. What matters most is that you continuously learn, stacking your selling skills over time. Over time, you'll build a well-rounded skill set, even if it takes years to become a closer who carries a quota.

As you hone your sales skills and grow your income, it’s becomes just as important to minimize your expenses.

Live On The Cheap

Last summer, my wife and I spent two weeks island-hopping in Greece. The beaches were great, the views were even better, and the gyros were to die for.

Since we both value travel but also desire to build wealth, we set aside $6k per year in our budget for memorable trips. We’ve been able to do this while still having room in our budget because we stay financially disciplined in other areas:

Spending Friday nights shopping at several grocery stores to find the best deals.

Preparing home-cooked meals on Saturdays so we rarely need to eat out.

Taking care of all our cleaning at home ourselves.

Waiting for Black Friday or other sales to buy shoes, electronics, clothes, or anything else we need.

If you take a closer look at your credit card statement, you’ll likely find that most of your purchases are nice-to-haves, not things you truly need. The key is to cut unnecessary expenses while keeping the things that are worth it to you.

The major key to accelerating your wealth—once you’ve got the earning and expense parts down—is to invest all the leftover budget.

Invest The Rest

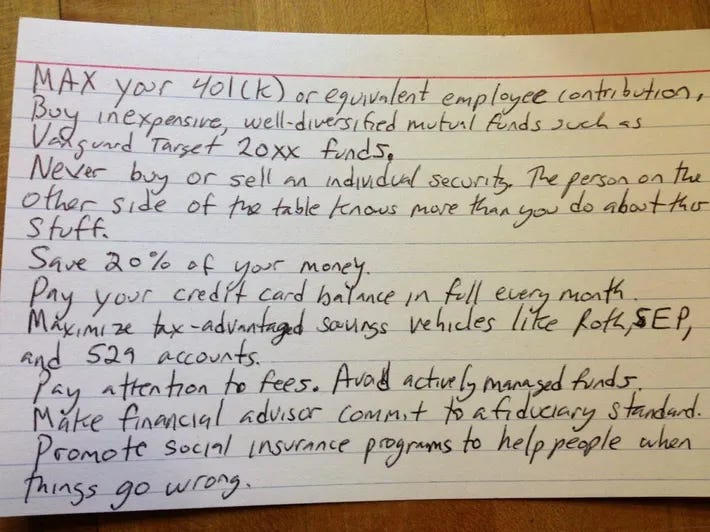

In 2003, Harold Pollack, a professor at the University of Chicago, had his world turned upside down when his mother passed away unexpectedly, leaving his disabled brother in his care. Faced with the sudden financial burden of caring for a loved one with high medical expenses, Pollack was desperate for answers. He searched far and wide to learn about personal finance—until he had an epiphany.

“All the financial advice experts have a simple set of things that they suggest you do. But all of them would say to tune out all the other stuff.” — Harold Pollack3

To help others, Pollack began chronicling his financial education in a blog. In 2013, he realized something that would become a viral sensation and lead to him writing a book.4

He discovered that the best financial advice can fit on a 3x5 index card, and it’s available for free at your local library.

Get Rich Quick By Getting Rich Slow

Ironically, the best way to get rich quick is to get rich slow. I’m saying this for me as much as I’m saying it to you, because I often forget that the key to lasting wealth is to build it slowly. When you build wealth slowly, it’s bound to last a lifetime.

As Charlie Munger said, “The first $100,000 is a b****,” but once you get that snowball rolling, the rest will follow.

— Grant Varner

These metrics are based on the CPI Inflation Calculator. It's important to note that the actual purchasing power of $100k from 1998 to 2025 can vary depending on your location and daily expenses. For example, $100k in 1998 is equivalent to $310,404 in San Diego, CA, but only $177,124 in Chicago, IL. The key takeaway is that the value of money has decreased over time, making it crucial to start building a nest egg as early as possible.

The 25x Rule is a retirement planning strategy highlighted by Financial Samurai. It suggests saving 25 times your annual expenses in a liquid retirement account, allowing you to withdraw 4% of the principal each year without depleting the funds. This strategy provides financial security, enabling you to choose whether or not to work, as your savings will generate passive income. Many people mistakenly include their home as part of their net worth in this calculation, but Financial Samurai argues that this is not sufficient. For more details, read Financial Samurai’s article here.

PBS NewsHour. All the Financial Advice You’ll Ever Need Fits on a Single Index Card. Watch the video here.

Harold Pollack, The Index Card: Why Personal Finance Doesn’t Have to Be Complicated (New York: Simon & Schuster, 2016).

This is awesome! Thx for the great tips!

By the way, I finished reading the Cold calling sucks!

All my calls I am now talking avg 3 to 5 min. Will be practicing and adapting the techniques