Carney confronted for sending billions to Bermuda tax haven

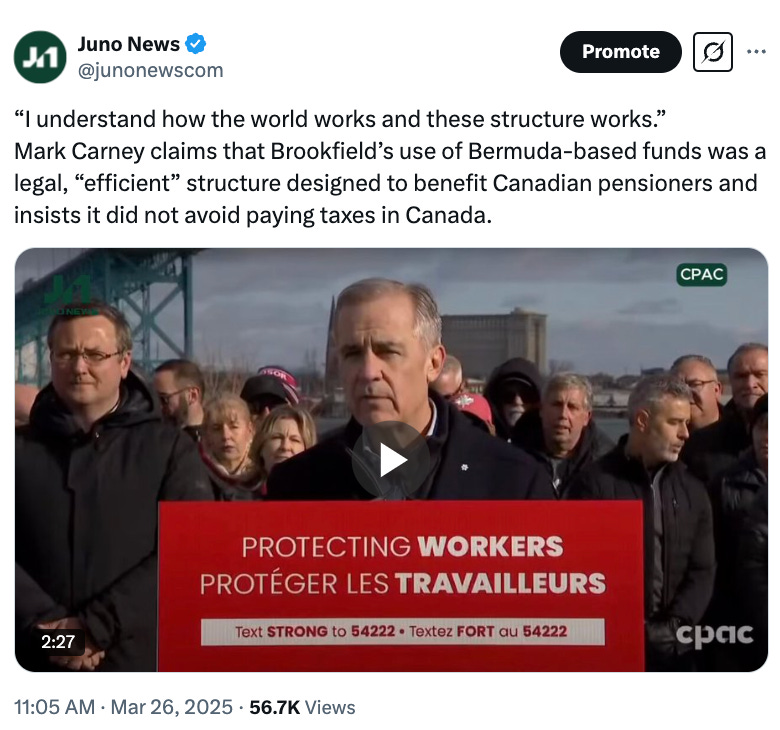

Mark Carney defended his decision to invest billions of dollars into offshore bank accounts in Bermuda on behalf of Brookfield Asset Management by saying he “understands how the world works.”

Liberal Leader Mark Carney defended his decision to invest billions of dollars into offshore bank accounts in Bermuda on behalf of Brookfield Asset Management by saying he “understands how the world works.”

Carney came under fire from reports for placing exorbitant sums managed by his former company into offshore bank accounts which enabled investors to avoid paying taxes.

When asked by a reporter whether he thought his actions were ethical, Carney responded by saying that he “understands how the world works” and is well-versed in global finance.

According to information obtained by Radio-Canada, Carney’s former role as a co-chair for Brookfield saw him investing funds worth $25 billion into offshore accounts in Bermuda and elsewhere. The funds were for net-zero carbon economy projects, which allowed investors to enjoy the perks that come with harbouring vast wealth in tax havens.

“I understand how the world works and how the structure works,” said Carney to a crowd in Windsor, Ont. when asked why he decided not to keep the funds within Canada.

The funds included a Brookfield Global Transition Fund worth $15 billion and the Brookfield Global Transition Fund II also worth $10 billion were both listed in the Ontario Business Registry as being registered in Bermuda.

When asked by a reporter whether it was “ethical” for the funds to be registered in Bermuda, a place well-known to the ultra-rich seeking to avoid taxes, Carney said that it was done to avoid being taxed twice.

Bermuda’s system offered “an efficiency of a structure,” he told reporters.

“The important thing… is that the flow-through of the funds go to Canadian entities, who then pay the taxes appropriately as opposed to taxes being paid multiple times before they get there,” he said. “The beneficiaries of those funds—teachers, retirees, municipal employees— they pay the taxes on their pension,” he said. “That’s the design.”

Carney was further pressed on what the advantage was of first funnelling the money through Bermuda and his response left many puzzled.

“It ensures that – it’s an efficiency of a structure so that it ensures that the flow through goes to the entities that are resident in the countries,” said Carney.

He was then asked point blank if it was a measure to avoid taxation, which he denied, claiming that the taxes would be paid by Canadians.

“It doesn’t avoid tax because the tax is paid in, for example, by all the examples I gave. The taxes are paid in Canada, yes? Okay,” said Carney.

Financial assets and his dealings with Brookfield have been a thorn in Carney’s side since he first entered the Liberal leadership race after he repeatedly refused opportunities to disclose his own finances.

He recently even called it “odd” for a journalist to inquire about potential conflicts of interest over his financial holdings earlier this month.

Conservative Leader Pierre Poilievre said Carney’s Bermuda dealings were a way to “dodge” the same taxes that the Liberal government forces on Canadians.

“Mark Carney hid his corporate assets in Bermuda to dodge the taxes that Liberals force on Canadians. He will always favour tax-havens—because his corporate assets are still hidden in one,” said Poilievre Wednesday. “He never puts Canada First!”

CityNews journalist Glen E. McGregor posted a copy of Poilievre’s personal assets which were sent to McGregor by his campaign upon request.

Poilievre isn’t required to disclose such information until after he is elected, an offer of good faith that McGergor noted should be enough to push Carney’s campaign to do the same.

he knows the way the "world works" ie crooks that cheat the system

Nice that Brookfield doesn't have to pay taxes ,just canadians!🤔