Greggs: Multi-Year Expansion Meets Near-Term Macro Headwinds

Initiation of Coverage (GRG LN) (Buy): Revenues and EBIT have been growing at ~10% annually, but P/E is now <16x after growth decelerated.

Highlights

Greggs has been a long-term compounder, growing EBIT at ~10%.

Differentiated model allows price leadership, continuing footprint growth.

Shares down 26% since last Thu’s update; P/E <16x, Dividend Yield 3%+.

Headwinds are macro & cyclical; EPS should continue growing each year.

At 2,102.0p, we see a 60% total return (18.0% annualized) by 2027YE. Buy.

Introduction

We initiated a Buy rating on Greggs, a U.K. food-to-go retailer with a market capitalization of £2.15bn ($2.63bn), after shares have fallen by 26% following a disappointing Q4 trading update last Thursday (January 9).

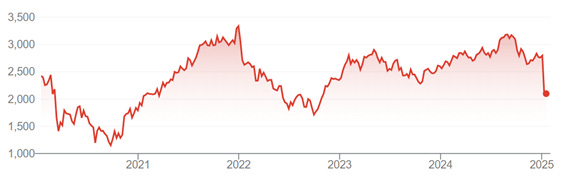

Greggs shares are currently 20% lower than a year ago, and at their lowest since November 2022:

Greggs Share Price (Last 5 Years)

Source: Google Finance (14-Jan-25).

We have been following Greggs since before COVID-19, and have initiated a small position last Friday (January 10).

We believe Greggs is a multi-year compounder whose trajectory is temporarily interrupted by cyclical macro factors. Shares are at ~15.4x expected FY24 EPS, and we see a high-teens annualized return over the next 3 years.

(The rest of this article is for paid subscribers only, but costs just $10 to unlock; a free sample of our research is here.)