Back to Our Regularly Scheduled Programming

More book, more AI, and some thoughts on Austrians/Gold

I was spared from travel this week and, as a result, had more time to think. Markets largely behaved as I expected, which also helped — freeing me to focus on the arcane rather than the mundane. I’m also going to skip the summary, because candidly I have no idea how to summarize these thoughts. If you want the book, you can quickly scroll down. Or you can humor me and read it all. You are paying for it after all.

“What is the outcome I am trying to achieve here?” — Cedric Chin via Dave Nadig

I love Dave Nadig even as I hate him. For those in the ETF industry, Dave is a conscience — the Jiminy Cricket of the industry. Few do a better job of focusing us on our perverse behaviors in the perverse world we exist in. When I write pieces like, “Be Better,” he’s the “Dave” I’m referring to. Invariably, I have received a phone call that begins with something like, “I’m so disappointed in you, Pinocchio.”

Dave has his own free-of-charge Substack and is an avid explorer of the metaphysical landscape in finance. He’s a believer in my theories of passive, but as we chatted this week, he challenged me with the above quote and shared his view that, “What I hope is that you write the book that says, ‘Here’s what YOU should do with your retirement funds.’” Unfortunately, Dave will be disappointed in me again.

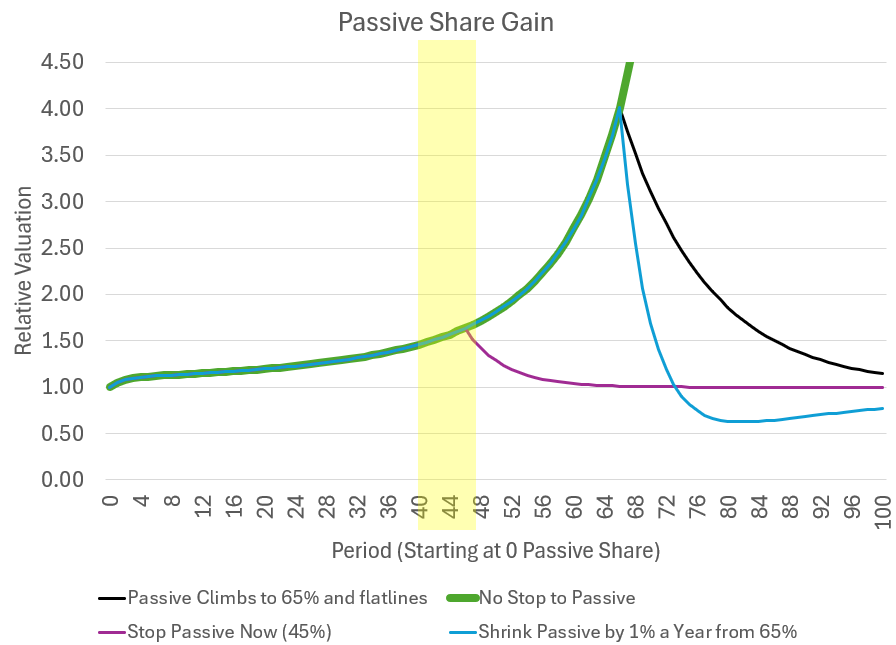

I CAN’T write that book because, IMHO, we are in Terra Incognita (parts unknown). I have a simple model, which I’ve shared briefly in a few places, of a potential evolution of valuations under a passive flow-dominated world. I emphasize that it is SIMPLE and subject to any number of variables — unemployment (as I’ve discussed repeatedly), demographics/retirements, policy (incredibly important), secondary supply issues (SPACs created temporary supply, as we’ve discussed), etc. But I firmly believe it is DIRECTIONALLY correct:

By current estimates, we’re somewhere between 40 and 48% passive by market capitalization. My estimates are far from Goldman Sachs’ self-serving estimates in the mid-20s and roughly in line with estimates from Marco Sammon and Valentin Haddad. IF we were to stop passive share gain today, we’d see something like the purple line — the proverbial lost decade many have called for (including Goldman). IF flows turn negative, then from this level, we’d get a very sharp correction back below normal, i.e., “a crash.” But if we continue along our merry way, I do not see why valuations do not continue to rise to levels that create genuine risk. At the current pace of passive gain, the pale blue line is about five years out. If the passive outflows begin from that level, the blue line suggests lost DECADES and a likely loss of capital markets as they exist today. Why would this occur? Because the population and capital of discretionary managers will be obliterated in the ascent and decline.

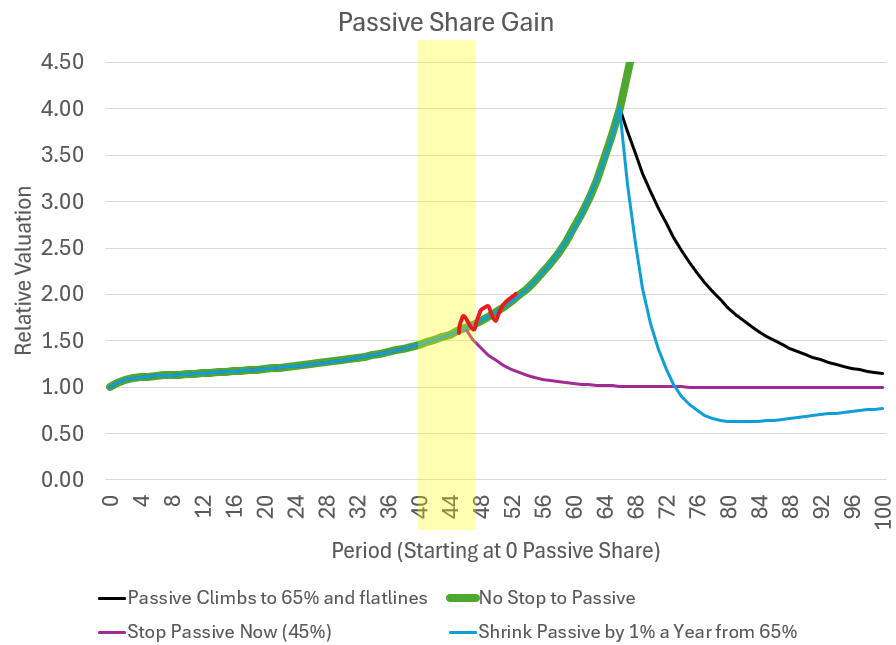

As I emphasized to a brilliant young quant at Simplify who was asking about the current sell-off, “We are discussing the red squiggles:”

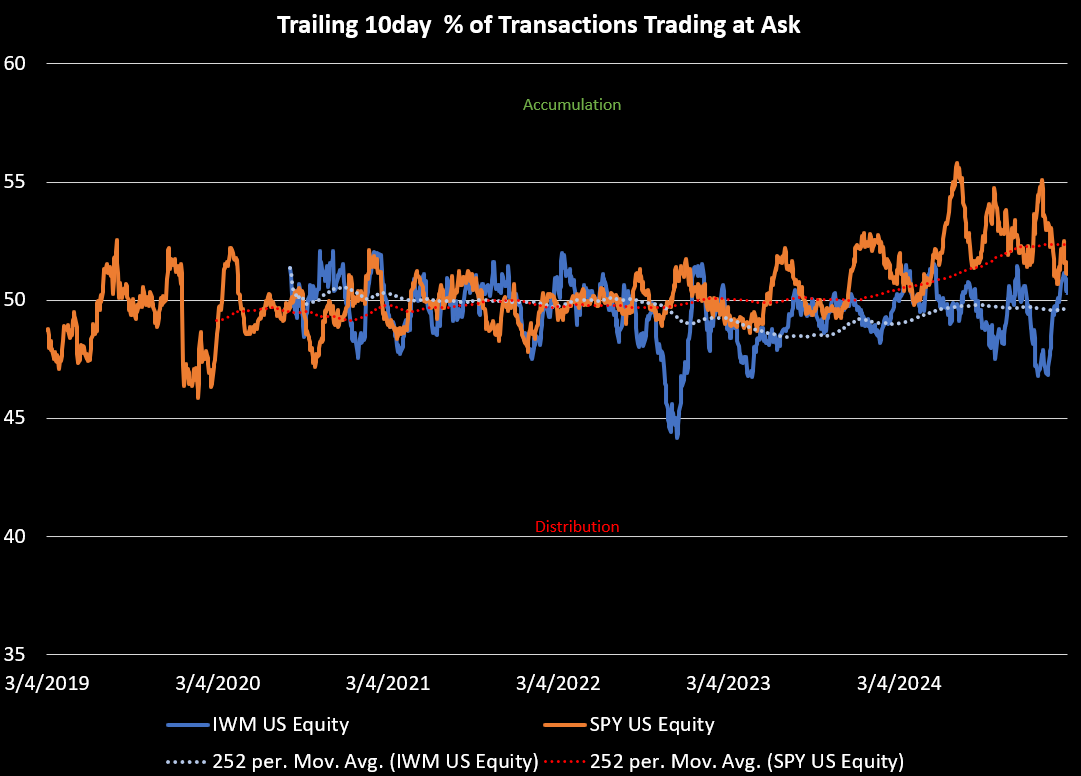

And as I’ve highlighted repeatedly on these pages, I think a big part of what’s occurring today is the unwind of the levered ETF phenomenon that powered gains in the 4th quarter:

The enthusiasm and flows that characterized the rise of the probability of a Trump administration are fading. Note that the fraction of trading ETFs transacting at the “ask” is beginning to fall propitiously, suggesting the “Trump” discretionary flows are done:

When does this stop?

But I’m watching closely for signs that the structural flows are abating and my answer continues to be, “Not yet.”

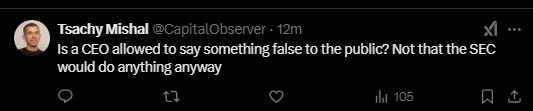

Last week’s piece went into detail about “what comes next” in product development. The emergence of digitally-native (tokenized) asset claims. And I’m very excited that the arbitrary barriers to development are falling even as I curse the incompetence that enables the current “Golden Age of Fraud” to persist. As one Twitter observer commented in response to one of my posts this past week:

But the old world must die for the new one to be born. And so I am perhaps more at peace (or in pieces) than I have been in a while.

“What is the outcome I am trying to achieve here?”

While I would love to be able to answer, “What do I do NOW?” my objective is far less ambitious (largely because I am Nate Bargatze/George Washington — “Nobody knows”/“I cannot tell a lie”). I aim to educate, explain (in advance) “Why” we are going to have to deal with the consequences, and (hopefully) claim a spot at the table as we redesign the currently broken system. Perhaps naively, I had assumed we might veer from the path; I no longer harbor such illusions. The pain is likely unavoidable. In the aftermath, I hope we can ask ourselves the question that I often try to orient listeners to in my too-frequent podcasts: “What is the outcome WE are trying to achieve here?” And maybe, if I’m lucky, I’ll get to help design products for that new world. More likely, one of my young readers will take that role. I wish us both the best of luck.

What We Have Here is a Failure to Communicate

On AI, I continue to emphasize that it is becoming integrated into our financial world, but as William Gibson identified long ago, “The future is already here, it's just not evenly distributed.”

Keep reading with a 7-day free trial

Subscribe to Yes, I give a fig... thoughts on markets from Michael Green to keep reading this post and get 7 days of free access to the full post archives.