Hi Multis

It's Sunday and you know what that means: your weekly Overview Of The Week. Maybe you read this on Sunday evening, with a glass of wine, in your favorite easy chair. Or on Monday morning, with your first coffee of the day, the best coffee of the day, as we all know. Maybe you are on your way to work or you are in Asia and already back from work before you read this. Or you read this during your lunch break.

It doesn't matter how you read the Overview Of The Week, I always hope you can experience the same level of pleasure reading it as I get from writing it.

Without further ado, let's jump in.

Articles in the past weeks

This is the fourth article this week. Let's look back at the previous three.

In the first article this week, I analyzed the Celsius earnings, the Alani Nu acquisition and how all of that influenced the quality of the company. I also looked at the valuation. You can read the article here.

I also added to the Forever portfolio and you can read about the additions in this article.

The third article examined Kinsale earnings. I also updated the quality score and the valuation. If you haven't read the article yet, follow this link.

Memes Of The Week

Just one meme this week.

Interesting Podcasts Or Books

This week, I listened to The Intrinsic Value Podcast episode about Airbnb.

You can listen to the episode here.

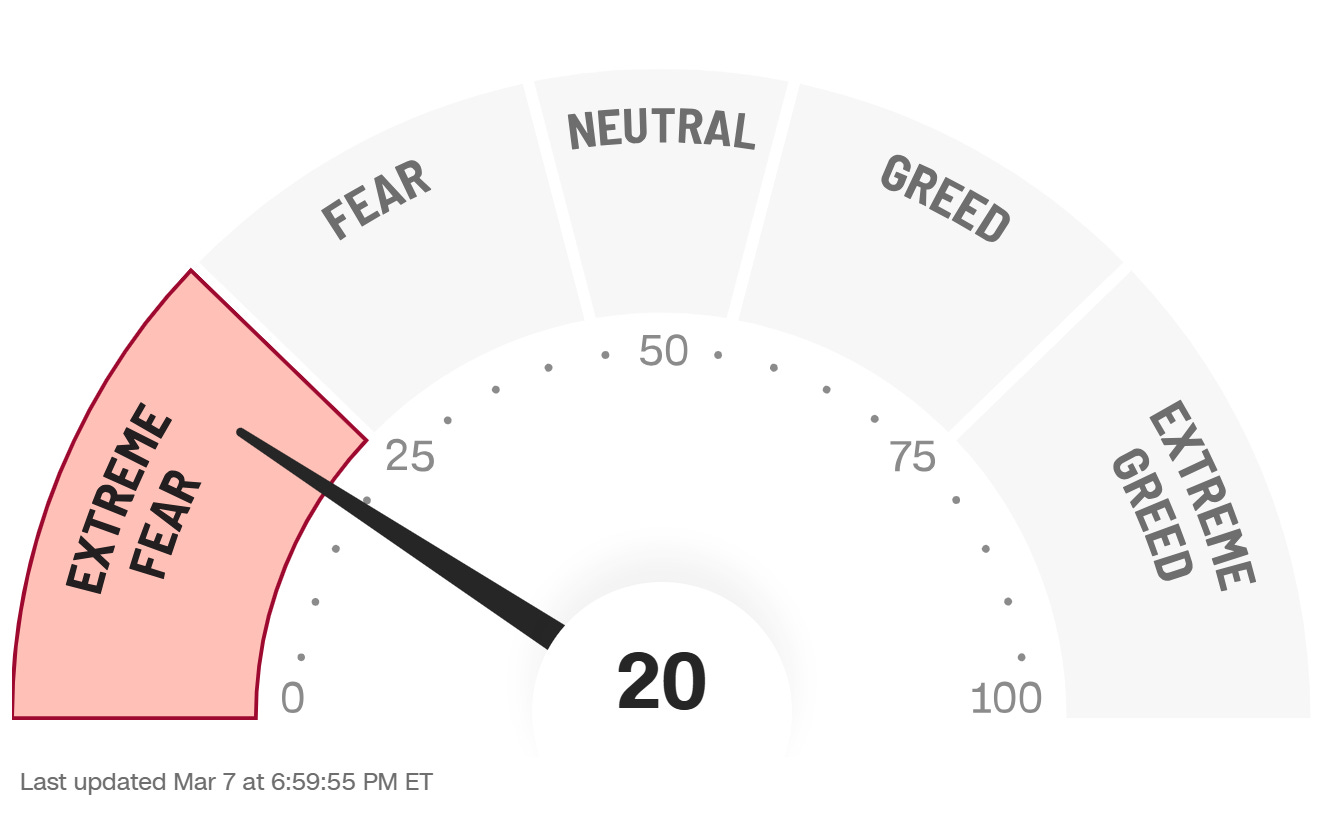

The markets in the past weeks

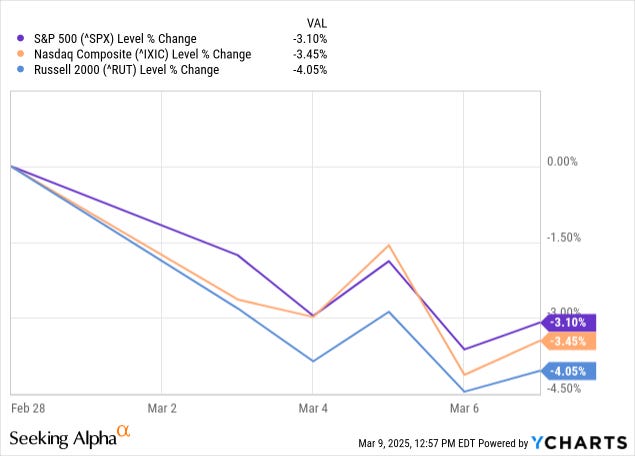

Often, I don't know exactly what the markets have done, but this week, I didn't have to guess. The markets were down. The S&P 500 dropped by 3.1%, the Nasdaq by 3.45% and the Russell 2000 by 4.05%.

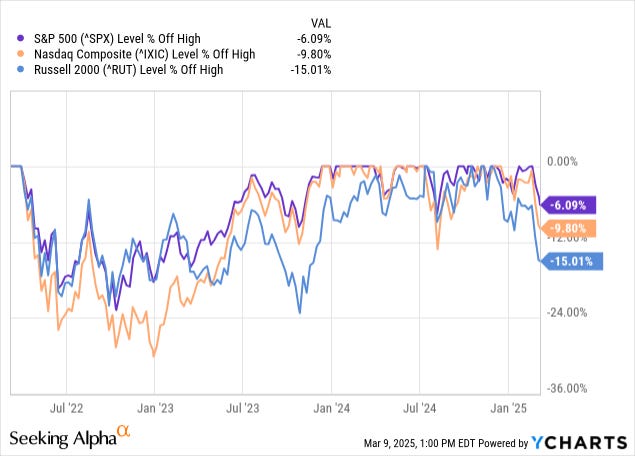

Those are pretty heavy moves. Some seem to be panicking already, but the indexes are not that for off their highs. OK, the Russell 2000 is down 15%, but it's a volatile index. The Nasdaq is bordering a so-called correction (down 10%) while the S&P 500 is down just 6.09% from its high.

Don't feel too depressed yet, or not too excited to buy the dip. I don't mean you shouldn't do that (I did this week) but just don't get overly excited yet.

The Greed & Fear Index remained in extreme fear.

Is ASML Doomed?

By Kris

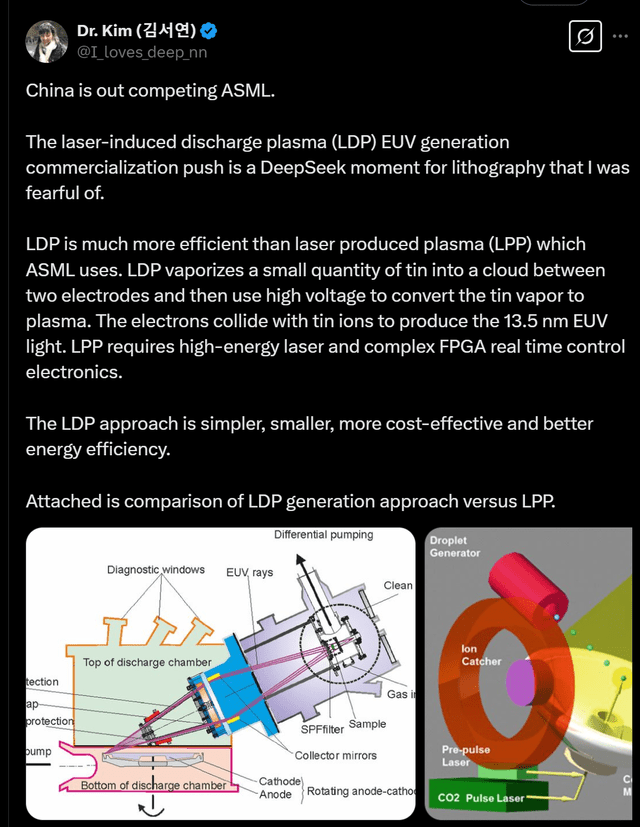

This post already got almost 900K views in less than 24 hours.

Sounds scary, right?

First, I think most won't understand this tweet and probably that's a part of the effect this author aimed for, so you just take the opinions at face value. like:

"China is outcompeting ASML."

" LDP is much more efficient than laser produced plasma (LPP) which ASML uses."

"The LDP approach is simpler, smaller, more cost-effective and better energy efficiency."

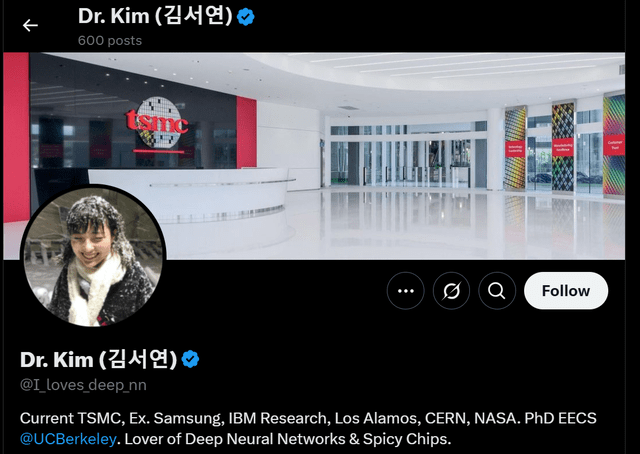

The author looks credible enough:

That's a top resume.

But I think Dr. Kim got a bit carried away. Her tweet was probably based on this.

But there are multiple reasons to doubt this.

First, the Chinese EUV machine is not even in a test phase. Only in Q3 of this year. But already claiming victory? That seems way too early. This is not like reproducing a gaming computer or so.

Secondly, LDP was already considered by several Western companies earlier. That's why a lithography engineer answered this:

There's a reason the industry chose LPP and not LDP. Of course, Chinese lithography specialists may have overcome the difficulties, but we don't know. One of the main reasons LPP was chosen is speed. It's unlikely LDP can do this at the same speed of LPP. Another one was accuracy. Have they overcome this problem? We don't know.

Thirdly, Dr. Kim should know this, lithography is much more complicated than that. Reliably etching chips suitable for AI, the multl-layer mirrors can currently only be made by one company, Carl Zeiss SMT. That's situated in Germany and ASML has a 25% stake in the company, bought in 2016 for $1 billion. There are companies in China and Japan who try to be in the same industry, but they are years behind. It's very unlikely that one company now shot forward all of a sudden.

Fourthly, even if they get it all right, yield matters... a lot. How many of the chips you produce are actually good chips? It's very unlikely that IF (!!) all other conditions are met, the yield of this Chinese EUV will come close to that of ASML.

Fifthly, I know this might be a shock to many (not), but this smells like Chinese propaganda. It's not like DeepSeek, where a paper was published so you could see it was no bluff. This looks like propaganda to show the West the middle finger about the export restrictions.

Sixthly, even in the unlikely case this turns out to be true, nobody outside of China will want to use this machine. Do you really believe TSMC will start using Chinese machines, which have been caught spying so many times in the past? Or Intel?

Conclusion: I'm not worried about this.

There’s more in this post, but that’s only for paid subscribers.

There’s a 20% discount on Potential Multibaggers, but it expires on Monday (really, you won’t be able to take advantage on Tuesday, you can check it).