There is no utopia waiting on the other side of Trump's economy

It's just pain now in exchange for more pain later.

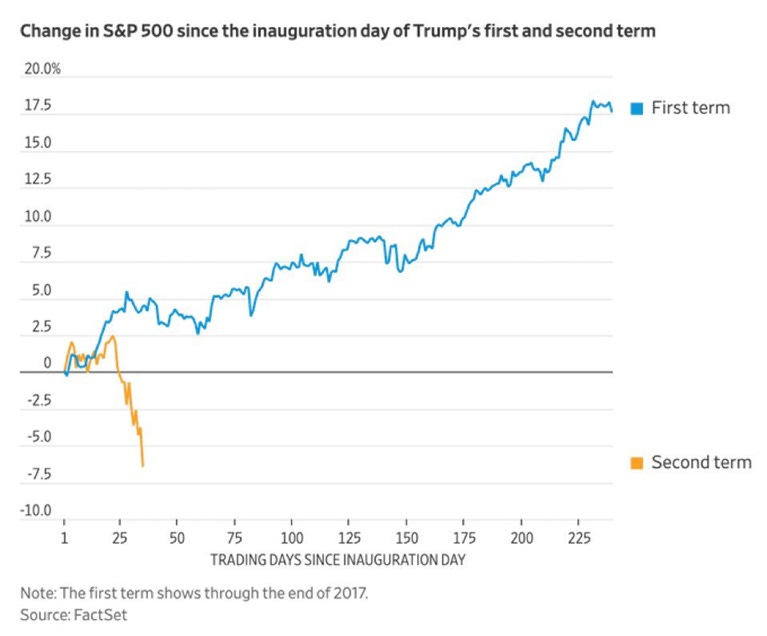

The carnage in the U.S. stock market continues. The S&P 500 is now down around 7.5% over the last month, and is lower than it was on the day before Trump was elected:

This decline means that relative to its all-time high a month ago, the S&P has now seen $4.5 trillion of wealth vanish into thin air. Yes, that’s “trillion” with a “t”. It’s equivalent to $4,500 billion, or $4,500,000 million. It is a large number. And it’s likely that the carnage isn’t finished yet. Crypto, which generally behaves like a tech stock, is down too.

This performance is among the worst of any President’s first 50 days in office. For example, compare it to Trump’s first term:

But unlike, say, Obama in 2009 — who came into office right in the middle of the financial crisis — Trump’s crash is entirely of his own making. Everyone seems to agree that Trump’s tariff policies are behind the crash. A man elected to fix the U.S. economy has instead gone after it with a baseball bat.

Trump and his people seem to be embracing the devastation. The party line is that this economic disaster represents temporary but necessary pain — a period of adjustment while Trump’s policies create a utopian future economy free of all foreign entanglements. In a statement that probably sparked the most recent selloff, Trump himself declared:

There could be a little disruption. You can't really watch the stock market. If you look at China, they have a 100-year perspective… we go by quarters. What we’re doing is building a foundation for the future.

Newsmax anchor Rob Schmitt wrote:

Ya. The Dow is plunging. This is happening because we have a President with the balls to undo a globalist economic agenda that’s decimated American wages and quality of life. This is the pain that comes from real change.

Chamath Palihapitiya, a Trump-supporting venture capitalist, told us to “Long Main St.” and “Short Wall St.”, suggesting that the devastation in the stock market is only hurting the finance industry while ultimately helping regular American businesses (or perhaps the businesses of the future, since today’s actually-existing Main Street businesses got hammered today along with everyone else, implying a poor long-term outlook).

Columnist Batya Ungar-Sargon even declared that the current economic wreckage was just a temporary step toward an economy based on “love of the country and love of your neighbor”, which Trump would “teach [business leaders] how to build]”:

Now, after reading something like that, you may be tempted to shake your head, walk away, and say “Oh my God these people are all nuts.” And you wouldn’t be wrong; there is zero chance that Donald Trump will teach American business how to build an economy based on neighborly love. Nor are the apparatchiks scrambling to curry favor with Trump by coming up with public excuses for stock market declines and macroeconomic weakness the type of people capable of teaching American businesses anything useful at all.1

And if you want to dismiss Trumpism because it pattern-matches to the failures of the past, I’m not going to call you crazy. “Autarchy” under Francisco Franco kept Spain poor for 20 years after the end of its civil war. “Peronism”, which emphasizes “economic independence” and is sometimes compared to Trumpism, led to Argentina falling out of the ranks of rich countries and suffering macroeconomic instability for many decades. “Import substitution industrialization”, which many post-colonial African and Latin American countries tried after they won their independence, is widely considered a colossal failure. The Ming Dynasty and Soviet Russia both doomed themselves by sealing themselves behind iron curtains. And so on. If you just want to look at those historical examples and say “Thanks, I’ll pass”, I respect you.

Nor will you be alone. Trump’s disapproval ratings are creeping up and economic expectations are headed down, as more and more Americans realize they got a bum deal.

But in general, the idea that short-term pain is necessary for long-term economic gain is not always inconceivable. For example, when Paul Volcker raised interest rates and causes two recessions in the early 80s, the resulting conquest of inflation probably paved the way for decades of good economic performance. Trump and his true believers probably really do think that cutting America off from the global economy will cause a bunch of new businesses to sprout up from the ground like mushrooms after a rainstorm, creating mass employment and economic equality and everything good that they dimly remember America having back in the 19th century.

But when I say that that possibility can’t be ruled out, I mean it in only the most technical sense. There are a number of obvious reasons why Trump’s utopian economic project is doomed to failure, and the temporary pain of a deliberate recession is just the gateway to even greater and longer-lasting pain down the road.

Why Trumpism will fail in the long term, not just in the short term

Keep reading with a 7-day free trial

Subscribe to Noahpinion to keep reading this post and get 7 days of free access to the full post archives.