Trump takes a baseball bat to the U.S. economy

Destroying Americans' livelihoods and wealth to satisfy the whims of a crazy ideology.

Despite steady GDP growth, low inflation, low unemployment, and record high stock prices, Americans told pollsters in 2024 that they were deeply unhappy with how Joe Biden had handled the U.S. economy. So they elected Donald Trump, who promised to lower costs for average Americans, create a new era of U.S. manufacturing and domestic investment, and so on.

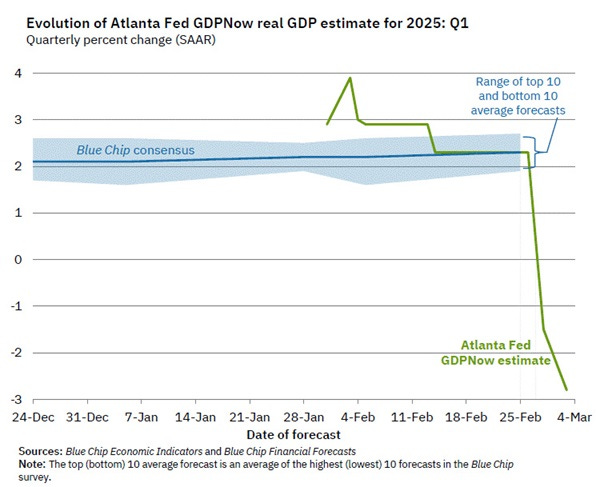

How is that working out? Well, the Atlanta Fed now projects that the U.S. economy will shrink at an annualized rate of 2.8% in the first quarter of Trump’s presidency:

The forecast was fine until it became clear a few days ago that Trump’s tariffs on Canada and Mexico would actually go into effect.

Now, this is just one forecast; the real number might be less dramatically bad. The Federal Reserve’s Beige Book, a survey of current economic indicators, suggests that growth will stall out but not go negative. An alternative forecasting method from the Atlanta Fed shows the same. But it’s very clear that the U.S. economy is slowing down, and tariffs are the driving force behind it.

I mean…what else could it be? Bloomberg cites “Elon Musk’s cuts to the federal workforce, the clampdown on immigration, and a potential drag on business investment amid so much policy uncertainty”. But while I’m worried that Elon’s ideological purge of the civil service will damage America’s state capacity, the amount of government spending that DOGE has cut so far is incredibly small; in fact, government spending has actually gone up slightly since Trump took office. And the Atlanta Fed’s forecast for private-sector GDP in the first quarter fell by substantially more than its forecast for total GDP; government spending is actually propping up the economy, while businesses suffer.

Nor is it likely that the immigration clampdown is having much of an effect. Curbing immigration does have a small negative effect on GDP, but it takes a while to manifest; it’s unlikely that American businesses were dependent on harnessing the asylum seekers pouring over the southern border.

Policy uncertainty is almost certainly a huge factor. Uncertainty is now greater than at any point in recent American history except for the early pandemic — even higher than at the height of the 2008 financial crisis:

Alex Tabarrok has a great post about this. What we’re seeing not just uncertainty about specific policies, but about America’s whole policy approach (or “regime”) going forward. That sort of radical uncertainty bites a lot harder. As a business, how the heck are you supposed to make long-term investment plans when you don’t even know what America’s basic approach to economic policy is going to look like in six months?

Policy uncertainty could be partially about DOGE, or the effects of Trump’s Ukraine betrayal on defense exports, etc. But every business that’s pulling back their investment plans is just screaming tariffs, tariffs, tariffs:

It’s no coincidence that American manufacturers are the ones yelling the loudest about tariffs. They’re the ones who most stand to be hurt. Tariffs on imported materials and components hurt American manufacturers more than they help, because they raise costs by more than they raise domestic demand for manufactured products.

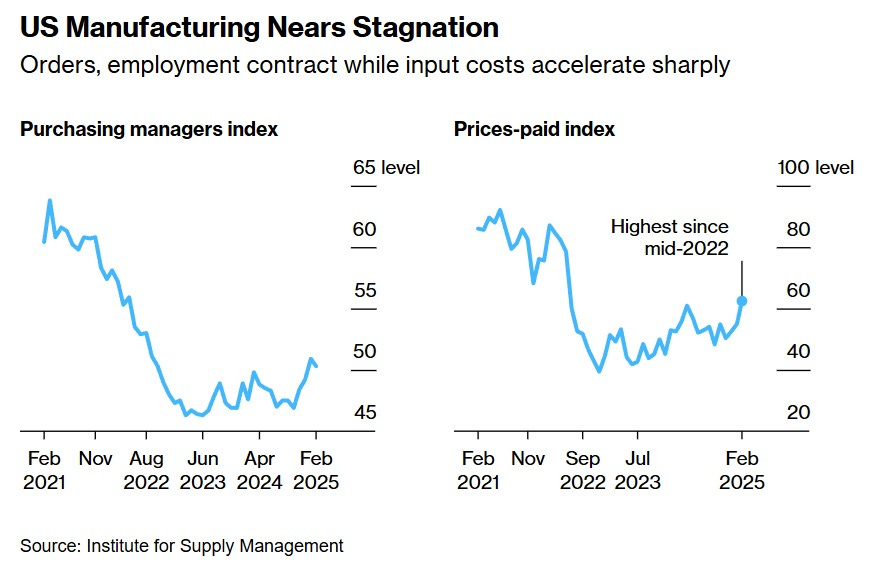

This is exactly what’s happening right now:

US factory activity last month edged closer to stagnation as orders and employment contracted, while a gauge of prices paid for materials surged to the highest since June 2022 as tariff concerns mounted.

The Institute for Supply Management’s manufacturing index slipped by 0.6 point in February to 50.3, according to data released Monday. Readings above 50 indicate growth. The group’s price measure increased 7.5 points to 62.4.

It’s just input prices, input prices, input prices:

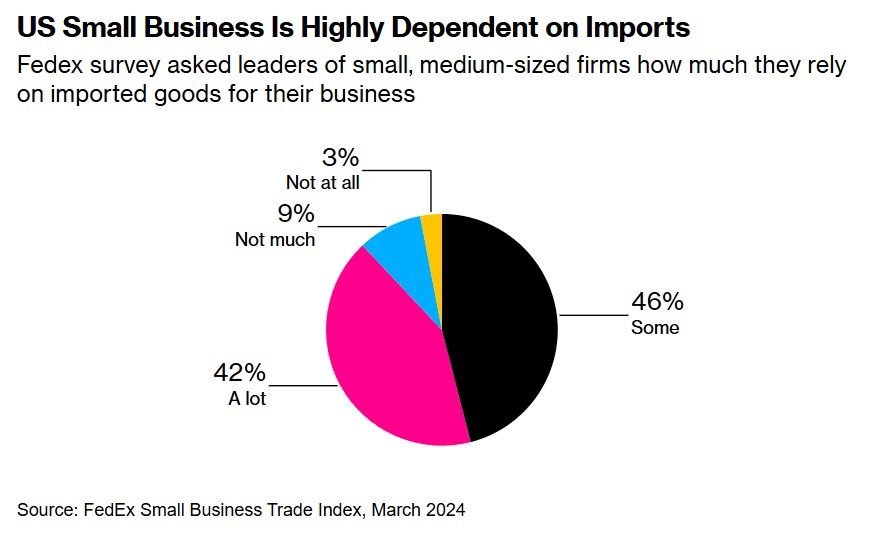

And small businesses — a reliable GOP constituency — are going to get hurt the worst. They’re heavily reliant on imported inputs:

Anguished complaints from small businesses dependent on imported inputs are pouring in to newspapers across the country.

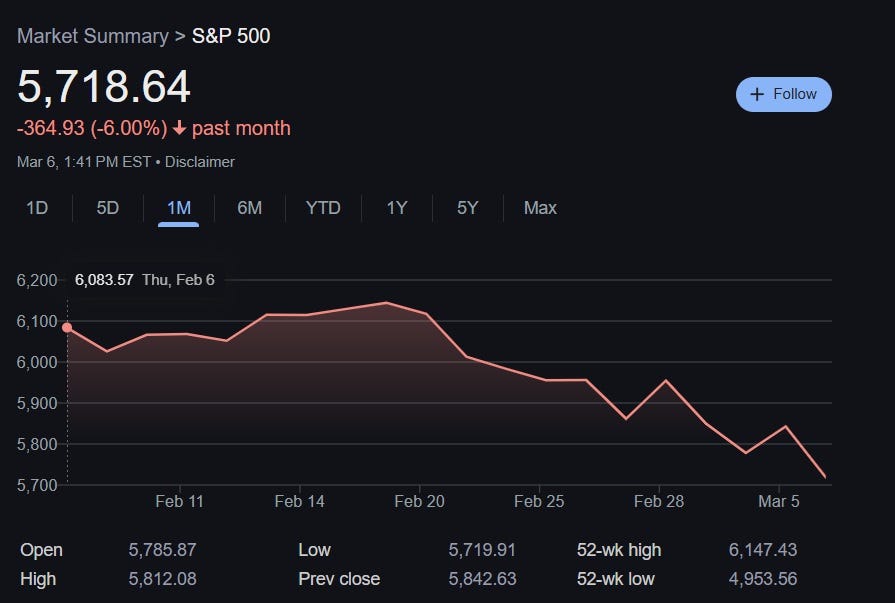

You can tell tariffs are going to hurt private business, because they’re crushing the stock market. As of this writing, the S&P 500 has fallen 6% over the past month:

Other stock market indices are doing just as badly or worse. The NASDAQ is down 8%. American stocks are badly underperforming their European counterparts.

In fact, there’s a fun video where you can see the market tank in real time as Trump makes it clear that his tariffs are going into effect:

Trump blamed “globalists” for the stock price decline.

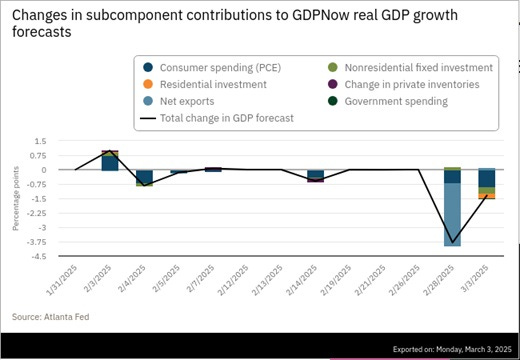

It’s not just business investment that’s suffering, either. Every component of economic activity is taking a hit from tariffs:

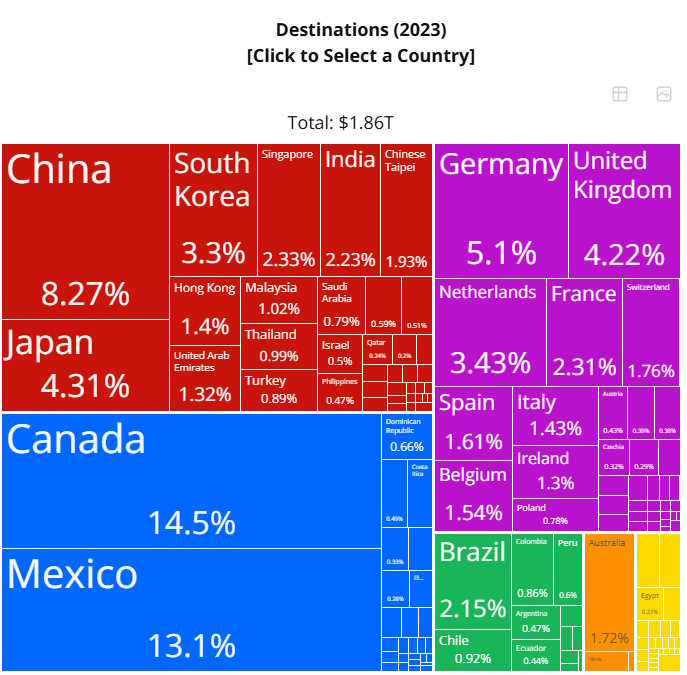

Private consumption is stagnating or falling, as you’d expect from tariffs making consumption more expensive — the Wall Street Journal has a good rundown of just a few of the things that are going to get more expensive for regular Americans (gasoline, food, electricity, home goods). Residential investment is stagnating or falling, because building houses requires imported inputs too. Exports are stagnating or falling, because tariffs make the U.S. dollar less competitive, and because Canada, Mexico, Europe, and China are bound to retaliate. After all, the countries that Trump is putting tariffs on are the same countries that buy the most U.S. exports:

Anyway, this is all very basic economics. Tariffs are taxes. They create deadweight losses. Tariffs make a country’s exchange rate less competitive. Targeted tariffs against a few strategic products are usually not very harmful, but broad tariffs just clobber a modern economy. Never say economists didn’t warn you.

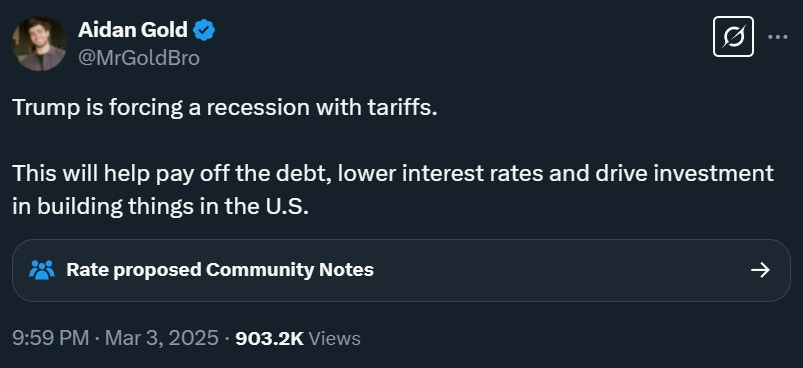

When it first became apparent that tariffs were tanking the market, Trump’s online defenders launched into a blizzard of incoherent rationalizations. Here’s just one example:

This is, of course, total nonsense. A recession lowers GDP (and thus reduces tax revenue) without lowering debt, making debt harder to pay off. Interest rates might go down if this were a demand-induced recession, like the Volcker recessions of the early 1980s — but a tariff recession would be a supply-induced recession, more similar to the oil shocks of the 1970s that made imports more expensive. That will tend to create stagflation, forcing interest rates higher and making the debt harder to pay off.1 As for investment in the U.S., it will be hurt by policy uncertainty, lower consumption, and more expensive inputs.

Some Trump apparatchiks tried to claim that the data showing a good economy before Trump were fake. In fact, I do expect the administration to try to gut the federal agencies that produce America’s economic statistics, in an attempt to hide bad data from the public. (Record grain harvests, comrade!) But this will backfire; people know when their businesses fail, when prices at the grocery store and the gas station go up, when they get laid off, and when the value of their stock portfolios go down. The only thing that monkeying with the official statistics will do is to make Trump and his people less able to respond to what’s actually going on in the economy.

When it became clear that none of these hastily invented excuses were going to fly, Trump’s supporters started telling Americans that they were just going to have to endure some economic pain. Manu Raju reports:

Some Rs acknowledge that there could be higher prices with Trump’s Mexico and Canada tariffs but believe their constituents would be willing to stomach that to back Trump’s policies…Sen. Markwayne Mullin told me "of course" he's worried tariffs could impact his state but argued that his constituents are willing to "do what it takes" to support the president's policy…“Are the American people ready to get the country back on track and do what it takes to make that happen? Absolutely… It’s going to affect a lot of companies. We’re going to have to adjust some prices for it, but the president is tired of people taking advantage of our country.”…Asked if his constituents are ready to pay higher prices, Mullin said: “I think our constituents are going to do what it takes to get America back on track. We’re tired of countries taking advantage of us.”…Rep. Mark Alford of Missouri told me he thinks tariffs are "going to have an impact," particularly on farmers….Asked if he thinks his constituents feel the same way about shouldering some of the costs, Alford said: “I think so."

Some touted the jobs making T-shirts and shoes that Americans could look forward to getting. Others proclaimed that stock declines were good, because they’d allow younger Americans to buy into the market more cheaply. None of these were particularly appealing prospects to Trump supporters in the business community, who already own stocks, and who are probably not that enthused about getting a job in an American sweatshop.

In one darkly hilarious moment, Trump’s Secretary of Agriculture told Americans to deal with sky-high egg prices by raising chickens in their back yard:

How did we go from “Make America Great Again” to “Everyone needs to become a backyard chicken farmer”? Did Mao Zedong rise from the dead and take over the U.S.A. while I wasn’t looking?

In fact, I do think something a little like that is happening. Unless Trump is being paid by America’s enemies to destroy the country’s economy — something I think is pretty unlikely — what we’re looking at here is an ideological project. Like Mao did in China in the 1960s, Trump is taking a baseball bat to the U.S. economy in order to follow his deeply held ideological beliefs.

But which ideology? I wrote that DOGE is an ideological project, but that’s all about anti-wokeness. Trump’s ideology isn’t the same as Elon’s; he isn’t raising tariffs in order to get rid of DEI or kick trans people off of women’s sports teams. Although his motives are always a bit murky, my best guess is that this is about a different ideology. This is about economic self-reliance.

Many types of ideological regimes emphasize a desire for self-sufficiency. North Korea has juche. Stalin had the Iron Curtain. Juan Peron had Peronism in Argentina. Franco had his autarky policy. China’s Ming Dynasty and the Tokugawa shoguns of Japan had closed-country policies. Even Xi Jinping has emphasized economic self-reliance over rapid growth.

Trump ultimately isn’t much different. His inherent suspicion of other countries makes him want to be less dependent on them. To Trump, this goal is much more important than Americans’ prosperity. It’s more important than manufacturing strength or the fate of the working class. It’s a political goal whose value to Trump can’t be measured in dollars or jobs or production numbers.

This is American juche. Our own Iron Curtain. America won the Cold War, then we looked at the country that lost and decided to be more like them.

Anyway, I waited two days to write this post, because I suspected that Trump’s commitment to his policy wouldn’t be absolute, and there might be some hasty walkbacks — as there were a month ago. In fact, I was partially right — Trump has now delayed the tariffs on Mexico for another month, and will also delay some tariffs that impact the auto industry specifically. (Update: Trump has now paused tariffs on Canada too.) Naturally, the same apparatchiks who cheered the tariffs a couple of days ago are now cheering the delay, praising Trump for the “art of the deal”.

But the more Trump uses these kind of last-minute delays and special exemptions, the less relief they’re going to create among the business community and among investors. It’s now clear that Trump’s tariffs were never a bluff, that he really means to enact as many of them as he can, and that his delaying tactics are just a way to ease America into the pain of being a poorer, more economically isolated country. It’s only going to get worse. And the uncertainty of exactly when and whom the tariffs are going to bite simply adds to the overall climate of fear and uncertainty.

America voted for a guy they thought would deregulate the economy and fix inflation — a modern-day Reagan. Instead they got a dime-store Mao, who would be happy to impoverish his nation just to see it be less reliant on the rest of the world. I think a little buyer’s remorse is in order.

Actually there is a theory that the anticipation of future supply shocks causes negative demand shocks today, in which case inflation could temporarily go down.

"Dime-Store Mao" sounds like a fun nickname for Trump moving forward.

It is even more frustrating to see free-market American business leaders be silent about this behavior, for fear of losing their communication channels to the administration. What a strange situation to be in.