“A Toad Does Not Run in the Daytime for Nothing”

That’s what I imagine Pete Edochie was saying to himself while scrolling through Instagram on a random afternoon in late November 2024, as yet another wave of baddies foreigners and IJGBs touched down at Murtala Muhammed International Airport for Detty December. Lagos always puts on a show for the holidays, but 2024? Different gravy.

By the time the festivities wrapped up, Detty December had officially become a global cultural touchpoint. “How Nigeria’s biggest city became the world’s hottest winter party destination,” a CNN headline declared.

But beneath all the partying, bottle-popping, and Lekki traffic, there was a practical problem: money.

For the diaspora Nigerians and foreigners visiting, spending and moving money was a hassle. The usual play was to bring physical cash, change it at a bureau de change, and have the naira equivalent sent to a friend’s local account (You don’t have diaspora friends? Oya, sorry).

It’s the kind of problem that’s ripe for a fintech solution, and Paystack’s Monday night product launch suggests the fintech has the answer.

Enter Zap: Paystack’s First Consumer-Facing App

On Sunday, I teased the worst-kept secret in Nigerian fintech: that a major Nigerian fintech was making a play in this “faster transfer” space. While Paystack has built its reputation as the infrastructure behind online payments, with Zap, it’s stepping into the consumer space for the first time.

Zap is marketed as the fastest way to complete a bank transfer in Nigeria (10 seconds), compared to the 22-second average time from 2022. During Paystack’s presentation, one use case that stood out was diaspora spenders.

Here’s Paystack’s CEO, Shola Akinlade:

“Today, we’re not targeting the remittance scenario. Our ideal scenario is for people from abroad to come to Nigeria and make transfers using Zap.”

Interesting positioning. It’s not quite remittances as we know them; no one is wiring school fees home or sending upkeep money to family. Instead, one of the things Zap wants to do is make it seamless for visitors to spend like locals.

There are other use cases, but that is the ideal if I take Sola at his word.

Just so I’m not the internet’s blithering idiot, I asked someone who used Zap in January 2025 (I hear half of you on Obasanjo’s internet were invited to test the app in the past year) to share a few thoughts. It was easier than downloading the app myself.

First thoughts on the app:

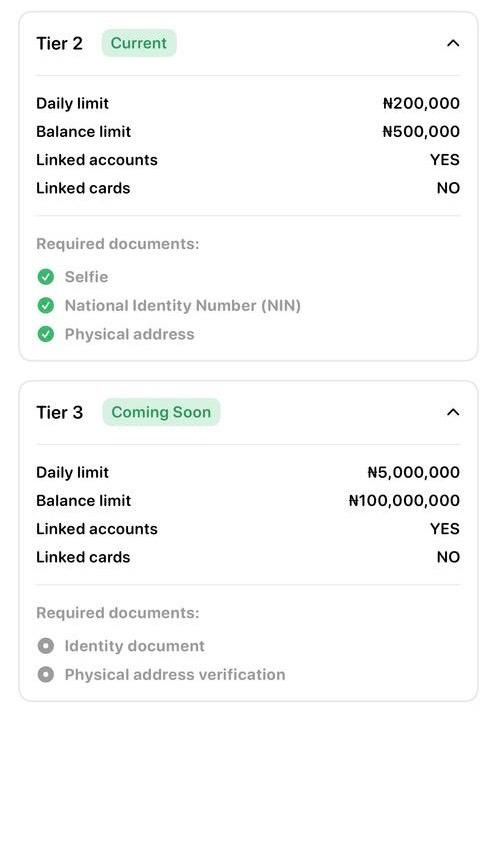

“It’s a beautiful, well-engineered app. I tested it early in the year while I was visiting Nigeria, and the first thing that stood out was the app limits. I immediately thought this app wasn’t really for someone like me.

Even if I lived in Nigeria, I don’t think I’d use it for everything. Maybe for an Uber or small transactions. I wouldn’t use it when checking out at the store. But for paying a handyman or quick microtransactions? That feels a lot more natural.”

On the diaspora use case:

“I tested the foreign card linking, and none of my cards worked at first. Eventually, they did, but the fees were higher than I expected. I imagine they can tweak pricing over time.”

“The use case I do see is for travelers. It could let you spend anywhere like a local without needing a Nigerian bank account. Kind of like those Lebara ads you see at the airport.

If Paystack has spent a year testing Zap, they now have about seven months to capitalize on the October–December travel rush. That’s a real shot at getting this product in front of the exact audience they’re targeting.

Also, at least two other people who tested Zap believe it can become a daily driver if the transaction limits are increased.

The B2C Ghetto Challenge: Can Paystack Compete?

Zap is a big move for Paystack because it’s a departure from everything they’ve done before. This is a B2B company that built its reputation on being the infrastructure for helping businesses process payments.

Now, they have to figure out how to put Zap in the hands of individual users in true B2C fashion.

Can they distribute this product at scale?

It’s a fair question. GTBank had a strong idea with HabariPay back in the day, but it had a difficult time getting the product to users at scale. Paystack has a strong brand, but the Nigerian fintech customer is addicted to giveaways and cheap or zero fees.

But Paystack has never been a “compete on price” kind of company. They’ve always focused on premium experiences, reliability, and elegance.

Ultimately, Paystack’s endgame with Zap will be key. Will they tweak pricing over time? (It currently charges N35 on a N10,000 deposit) or will they lean into a premium positioning and hope enough users care about speed and design? Or is Zap a complimentary product, something Paystack is happy to have this product be a loss leader?

Before you accuse me of leaving you with too many questions, I’ll end with a poser of my own because I found the promise of a 10-second transfer fascinating and I wrote about super fast bank transfers on Sunday.

In Nigeria, instant transfers solve a trust problem. I want to send you money and be certain my bank (or yours) won’t pull a fast one. While Instant transfers have been around in Nigeria long enough, they didn’t always translate to trust because they were wonky and unreliable. In that time, all the Chinese-backed fintechs and the latest Unicorn have truly solved reliability.

“I sent it from X/Y/Z app” is pretty much a proxy for trust these days and I reckon those transfers take something like 20 seconds.

Am I willing to pay more to make another app my daily driver for more speed when the real problem is reliability? I’m not entirely sure, but customers are fickle. We could rail against a product today and download it like it’s going out of fashion tomorrow.

Honorable mention to Mono’s product Owo which also lets you send money on Whatsapp in super quick time. As far as the fork in the road goes, the “faster transfer” people are flying out of the blocks.

Did I miss an angle or a potential use case? Let me know in the comments or shoot me an email!

Back to back articles, trying to balance out the months you left us?

Feels like I'm not in the ecosystem with you people oh because everyone knew about zap apart from me??