Strangling $TSLA with the #SimpleOptionsDayTrade strategy for a quick Friday $2000 profit--02/14/2025

They say buying options is a “fool’s game” and day trading options is impossible. So let’s say right off — they are wrong about that.

THE SIMPLE OPTIONS DAY TRADE SIGNAL

If the SPY call or QQQ call or a STOCK call is above its open, buy the calls. If the SPY or QQQ put or a STOCK put is above its open, buy the put.

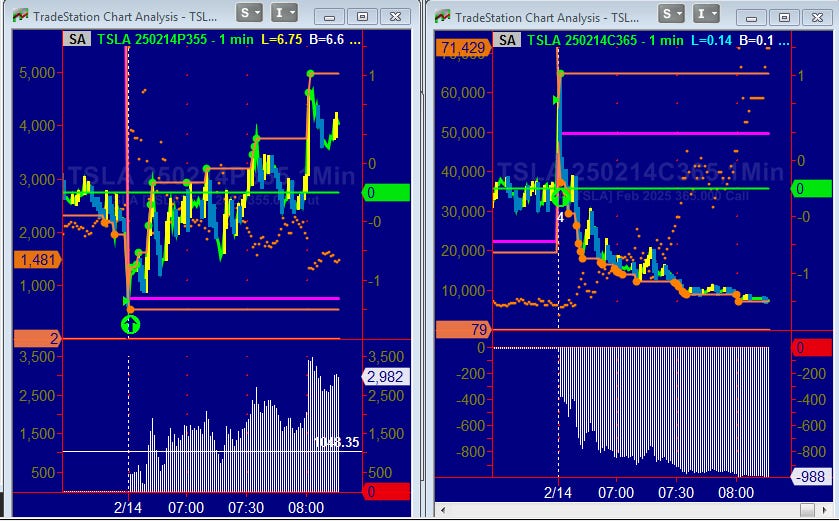

(The purple line on the chart below is today’s open.)

THE PROFIT TARGET

At least, a 100% gain for the day.

THE SELL SIGNAL

Never hold overnight. It is a day trade no matter what.

A long strangle gives you the right to sell the stock at strike price A and the right to buy the stock at strike price B.

The goal is to profit if the stock makes a move in either direction. However, buying both a call and a put increases the cost of your position, especially for a volatile stock. So you’ll need a significant price swing just to break even.

The difference between a long strangle and a long straddle is that you separate the strike prices for the two legs of the trade. That reduces the net cost of running this strategy, since the options you buy will be out-of-the-money . The tradeoff is, because you’re dealing with an out-of-the-money call and an out-of-the-money put, the stock will need to move even more significantly before you make a profit.

TODAY’S TRADE EXAMPLE—TSLA

TSLA opened at 360, a perfect strike for the strangle strategy:

Buy the 360 call, expiring today and the 360 put, also expiring today.

Given it takes a big move to realize a significant profit depending on the 355 put moving from at-the-money to in-the-money and staying in the money.

SO WHAT TO DO? WHAT TO DO?

Duh…when there is $2000 on the table for the taking—TAKE IT!

That is 50% gain for the day trade on $1K in each strike.

It may go totally crazy by the end of the day since the put can keep on going but it does not hurt to take the two grand and head off to a holiday weekend.

(The while flags the charts’ right axis show the dollar gains for each $1K traded. Click on the chart for a larger view.)