TL;DR: There is no ‘fiscal black hole’ and the politicians and news editors who gave the vague and unsourced suggestion of one unelected politician should be ashamed of themselves for giving it public airtime, let alone asking Parliamenary questions about it. Lizzo’s HR problems are more of a news story.1

Paying subscribers can see more detail below and hear more in the podcast above. Join them in supporting our journalism in the public interest on housing, climate and poverty by subscribing in full. An update. I have decided to open this up to all after subscriber requests. Please feel free to share and we’d love you to join us as a full subscriber to support this work.

The people who study fiscal policy and Government borrowing for a living and can get sacked if they do it badly knew it was a joke, and not because they watched National Finance spokesman2 Nicola Willis accidentally make it a joke in Parliament yesterday3.

It was actually a joke because less than half an hour after she repeated Winston Peters’ claim of a ‘fiscal black hole’ in Question Time, those fund managers bid $1.037 billion to buy $500 million worth of Goverment bonds for an average yield of 4.80%4. That strong bidding kept the yield flat in secondary financial markets:

at the same time as a global bond selloff that saw yields on the bonds deemed the safest in the world (US Treasuries) rose 20 basis points to a record-high for 2023 of 4.19% because of actual fears of an actual fiscal deterioration in the United States;

at a time when annual inflation in New Zealand is still reported to be 6.0%; and,

at a time when there is a real prospect of a hung Parliament within nine weeks.

These fund managers were so keen to lend their money to an institution allegedly “in financial panic mode”5 that they gladly handed it over to Treasury’s Debt Management Office, knowing they were receiving a negative return after the corrosive effects of inflation on the buying power of that money. In other words, these professional investors were so confident they would get repaid and that there was no actual fiscal crisis that:

they were willing to essentially hand over a gift to taxpayers of the difference between the yield of 4.8% and the inflation rate;

they were willing not to receive any compensation for the risk they took, or the time they don’t have the money; and,

they were willing to hand that money over knowing the Treasury6 would come back to them next week, and the week after that, and the week after that, to borrow another $500 million per week.

That bidding yesterday included $220 million worth of bids for $75 million worth of 30 year bonds. Those fund managers were so confident about the Government’s finances they bid nearly three times the amount available, knowing they would probably be retired or dead before the Government had to repay it.

That is the definition of confidence. And we know what a real crisis and a real collapse in confidence looks like. Bond yields spike wildly. Bids dry up in auctions for Government bonds. Volumes in secondary trade dry up. Credit ratings get downgraded. We saw that happen globally for periods in the GFC, and in New Zealand in the mid-1980s and the early 1990s. Those were real crises.

This outbreak of ‘fiscal black hole’ name calling is not indicative of a crisis. Anyone familiar with fiscal policy, Government borrowing and financial markets knows this. But it seems some politicians and news editors don’t.

So what actually happened and why is $20b fake news?

Let’s back up a bit.

Apparently, rumours started circulating in Wellington on Wednesday that Finance Minister Grant Robertson had received a concerning early briefing about the Treasury’s Pre-Election Fiscal Update (PREFU) due to be presented on September 12.

NZ First Leader Winston Peters, who has sat in countless cabinet and budget committee meetings over 30 years and should know what a real fiscal hole looks like,7 then tweeted8 that he had heard some stuff we should all believe:

“Is it true that State Services Commissioner Hughes met with heads of ministries yesterday to address a $20 billion hole in government revenue? The alleged purpose of the meeting was for all ministries to find and claw back cuts of 10% of Core Crown Spending to the Consolidated Fund. One guess what the Pre-Election Fiscal Update will look like on September 12?” Winston Peters via X

A simple calculation of 10% of total annual core Crown spending ($128.9 billion) actually gives you $12.8 billion (not $20 billion), but anyone who has looked at the Crown Accounts for more than a second or two knows that cutting spending 10% would mean slashing things like NZ Superannuation payments, which are forecast to be $19.5 billion in the just completed financial year, up nearly $2 billion from a year earlier. Total spending on public servants, including teachers and nurses etc, is $32.2 billion. Cutting 10% of that might generate $3.2 billion, but would mean mass sackings of teachers and nurses etc. Not going to happen.

So what is this ‘blowout’ that is being bandied about?

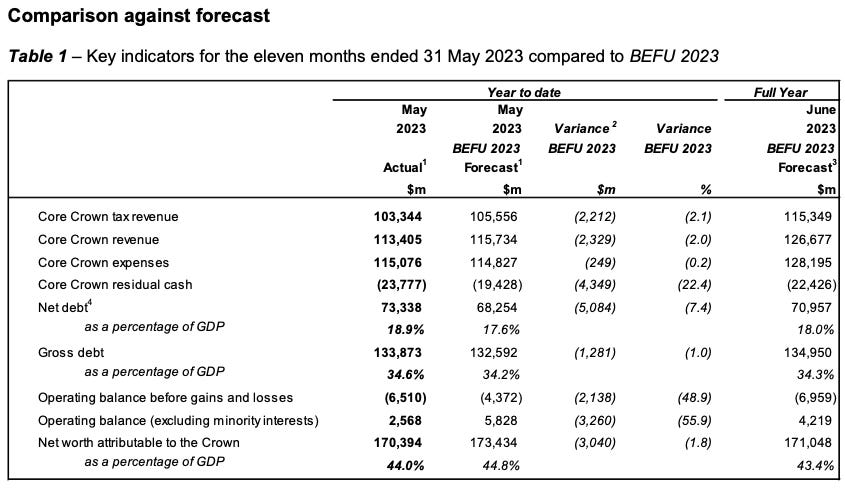

We don’t have to guess that tax revenues will be lower than expected because Treasury reported less than a month ago that tax collections for the 11 months to the end of May were running $2.2 billion behind the Budget 2023 forecasts for the 2022/23 fiscal year. That’s because of the slowing economy and is mostly due to lower company profits. Here’s the detail in table form9.

Core Crown spending is actually running $249m less than expected, which means the ‘gap’ is less than $2 billion. Corporate tax receipts are forecast to be just over $20.5 billion. Now this appears to be where the ‘10%’ number comes from. That leaves a shortfall of around $2 billion, which is what we aready know about.

So let’s say the numbers have worsened a bit in the last couple of weeks. At worst, the $2 billion shortfall could become $3 billion or so. The actual new ‘news’ is $1 billion, which is two weeks worth of borrowing, and the same as what the fund managers offered to the Government this week. Let alone, next week and the week after that.

Moody’s, who are paid to understand fiscal policy, reaffirmed New Zealand’s AAA credit rating yesterday.

Then Nicola Willis heard a few whispers from those who had heard whispers. Here’s the beginning of the fiscal exchange in Parliament yesterday. I’ll reproduce it in full for those who think I’m being harsh (bolding mine).

NICOLA WILLIS (Deputy Leader—National) to the Minister of Finance: What update on the fiscal outlook, if any, have Public Service chief executives been informed of at recent meetings reported to have been held with him, and what updated requests for spending restraint, if any, have been directed to those chief executives?

Hon GRANT ROBERTSON (Minister of Finance): In answer to the first part of the question, I met with Public Service chief executives yesterday, as I have done several times in the last three years, as part of the Government's fiscal sustainability and effectiveness programme, which we announced in Budget 2023 in May. Public Service chief executives are aware of the most recent update of the fiscal outlook, as other New Zealanders are, and the Government accounts for the 11 months to May 2023 that were released in July. The next update will be the pre-election fiscal update, in September. In answer to the second part of the question, public sector chief executives are aware of the need to continue to make efforts to meet the Government's fiscal rules and return the Government accounts to a more sustainable fiscal position following the significant investments required to deal with the effects of the global pandemic.

Nicola Willis: Is it correct that specific Government agencies, including the New Zealand Transport Agency, were directed to find savings of at least 2 percent?

Hon GRANT ROBERTSON: The Government's fiscal sustainability and effectiveness programme is an ongoing programme. Any decisions that would affect departmental budgets will be dealt with in the same way that all Budget requests and decisions are made, and will be announced when it is appropriate to do so.

Nicola Willis: Is it correct that the finance Minister, at the very last minute, has realised that the pre-election fiscal update will be a complete debacle and so is trying to quickly get decisions into Cabinet minutes to try and paper over the crevasse in the Government accounts?

Hon GRANT ROBERTSON: The member clearly wasn't listening to my primary answer. In the Budget in May, we had $4 billion worth of savings that we found, and we announced our fiscal sustainability and effectiveness programme—page 64 of the Budget documents, for the member's reference. It is an ongoing programme of work because we are a responsible Government that seeks to make sure that we manage what is in front of us and seeks to make sure that we get a balance between fiscal sustainability and supporting New Zealanders. The only person who should be worried about a fiscal crevasse, to use the member's words, is the member, who cannot pay for the promises that she is making.

Nicola Willis: Why is it, after six years of spraying New Zealanders' money around with wild abandon, that he has, at the midnight hour, worked out that perhaps the bureaucracy should tighten its belt, and only now started issuing those directives?

Hon GRANT ROBERTSON: Again, I repeat the answers that I have given. In Budget 2023, there were $4 billion worth of savings identified. We have an ongoing sustainability and effectiveness programme. I think what we're seeing here is a member who can see in front of her the fact that she couldn't pay for the promises that have already been made, and if she hasn't been keeping up with where the Government accounts are, that's not our responsibility. She now has to be the one to find some way of repairing the fiscal hole in National's plans.

So Nicola Willis had heard about requests for 2% cuts on NZTA’s $5 billion per year spending. That’s $100 million at best. That is a fifth of one week’s worth of ‘blowout’.

Where’s the ‘black hole’? It went up in a puff of hyperbole.

It went from $20 billion in the twitter stream of Winston Peters to $100 million on the floor of Parliament. This is the full statement from Willis to give readers a sense of how far the words are from the numbers.

The Finance Minister must urgently front-up about New Zealand’s precarious financial position and respond to reports of an enormous hole in the Crown finances, National’s Finance spokesperson Nicola Willis says.

“There are now widespread leaks and reports suggesting the Labour Government is in financial panic mode.

“It’s alleged that New Zealand’s rapidly declining financial situation is now so much worse than forecast in the Budget, that Grant Robertson has instructed Public Service leaders to batten down the hatches and desperately dig up major savings to help cover-up a growing crevasse in the government books.

“The Labour Government has sprayed the public money-hose with such wild abandon that New Zealand’s Crown finances are now teetering on the edge.

“This is Labour’s mess and Grant Robertson’s last-minute clean-up job is far too little, far too late.

“At every opportunity the Labour Government has resisted the need to instil financial discipline and fiscal rectitude.

“Now the cupboard is bare.

“If these reports are true, this is beyond politics now. Mr Robertson must front-up up on the real state of the books or resign. A major deterioration in New Zealand’s fiscal position would have a massive impact on taxpayers, the economy, and the public services Kiwis rely on.

“National is ready to manage the economy in the interests of all New Zealanders. We have a plan to fix the economy, beat inflation, and get New Zealand back on track.”

In just over three months the author of these words could have to front up to actual investors and credit rating agencies to talk about the state of the Crown’s finances. And she has to instil confidence. This is not the way to do it.

Other places I’ve appeared this week

cheers

Bernard

Not knowing the accusation was serious would be very bad enough for the credibility of a politician auditioning to be Finance Minister. Knowing it was and opportunistically using it anyway to grab a news cycle is even worse.

If he has read all the cabinet and committee papers that someone has given him to read….

Or should that be ‘X’-ed?

It’s pretty hard to turn a table or spreadsheet into a joke.

The 'fiscal black hole' talk actually is a joke